Grid 2050 reality check update

"Grid 2050 reality check update" article about the United States grid at mid-century was published in T&D World online in October 2019. Michael Heyeck, our Marketing & Communications Task Force convener for the Steering Committee, authored this article at the invitation of T&D World. He has several other articles published by T&D World including articles about CIGRE’s centennial and E2E published earlier in Electra in 2019, and about supporting NGN more than five years earlier.

The 2019 Annual Energy Outlook (AEO on EIA.gov) for the United States suggests in its reference case Grid 2050 electricity demand will be served largely by wind, solar, and natural gas. This article is an update to my September 2014 “Straight Talk” Column in T&D World on the subject.

Looking at Grid 2050, my conclusion is “Really? Isn’t there anything new?” Electric utilities and others in this sector should envision Grid 2050 in the United States technologically, economically and securely without simple extrapolations of the status quo. Disruptors will occur. Many are moving in the right direction, but let’s start with the easy extrapolations first.

Grid 2050 will grow in electric energy demand (including all end use) from 4200 TWhs in 2018 to 5500 TWhs in 2050. This is less than 1% in annual growth. Electric generation capacity grows from 1050 GW (plus 50 GW end use) in 2018, to 1500 GW (plus 250 GW end use) in 2050.

Natural gas and renewables grow in electricity generation from 52% in 2018 to 70% in 2050. Nuclear, coal and others (not shown as 1%) decline from 48% in 2018 to 30% in 2050.

Figure 1 - Electricity generation from selected fuels

Renewable electricity generation grows substantially fed by solar. Solar grows from 13% of renewables in 2018 to 48% in 2050. Residential solar is growing at 8% annually with the commercial side at 5% annually. Wind wanes a bit but remains a large part of the electricity generation puzzle.

Figure 2 - Renewable electricity generation, including end-use (Reference case) - Billion Kilowatthours

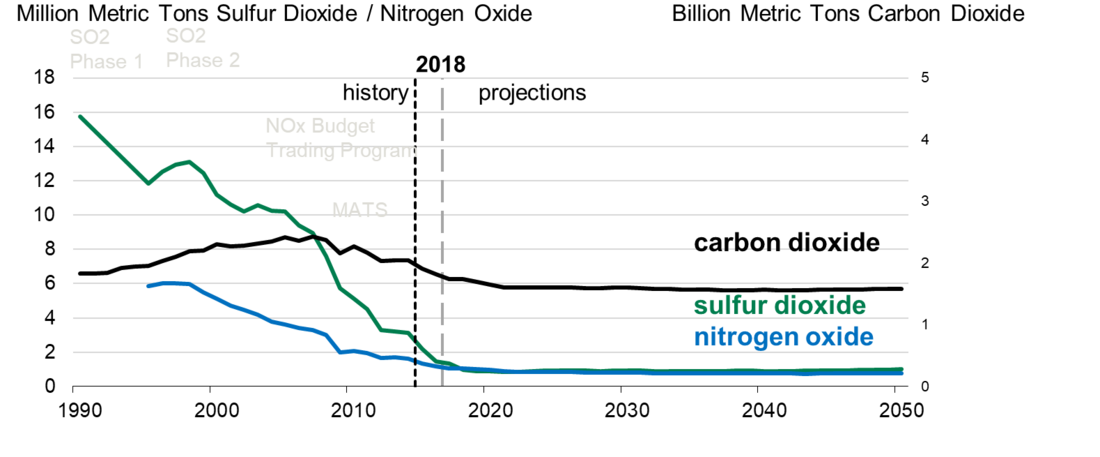

The electricity sector is doing well with emissions reduction despite a 30% increase in electricity generation, but not shown, the transportation sector stagnates with continued carbon emissions. The transportation sector is ripe for greater electricity penetration and power to gas as well.

Figure 3 - Electric sector emissions (Reference case)

Five years later after my September 2014 article, we extrapolated with some successes in energy storage, and good growth with renewables. But we are still relying on natural gas as our default. We want decarbonization, yet we are closing zero emission nuclear plants and advanced nuclear technology is nascent. We want firm renewables, but energy storage is still a small player. We hear about power to gas (hydrogen) and wonder what role it may have to disrupt electricity and transportation.

We just passed the 140-year anniversary of the invention of the light bulb (October 21, 1879). Who knew how that invention would disrupt for the better? I believe battery energy storage systems and other storage technology will be a positive disruptor to firm renewables at the micro and macro level. Technology is moving in the right direction and funding opportunities are happening, both in the private sector and the government sector.

But we need to push the envelope more to pursue other options for electricity. I believe we have not pressed, nor have we funded advanced nuclear generation to develop safer technology, small modular reactors, and micro reactors. I am not an expert in nuclear, but I believe a breakthrough can be made to provide electricity with nuclear at safe levels exhausting the fuel better. Yeah, I am an idealist, but so was Thomas Edison. I find with interest the developments at the US Department of Energy and some in the private sector (e.g., terrapower.com).

Hydrogen has been mentioned as well. Power to gas may develop hydrogen for uses such as transportation. We are not done inventing, and this may be another disruptor, adding greater electricity use for substitution of other energy processes that are more detrimental to the environment. And, projections for growth of electric cars may be understated as well.

And did I mention potential applications for e-farming? Electricity again to the fore as solution for “hardening” farming potential with yields less weather dependent. Can you think of applications for which electricity can better serve in place of other processes? Perhaps far-fetched thoughts of costly outcomes, but did Edison think about cost first?

Let’s move a bit to another subject. In every conference about electricity, you hear the word resilience. I love it when the industry adopts a term that can be defined many ways. Smart grid was the undefined leader years ago. People asked, “Did we have a dumb grid?” Smart grid applications and implementation turned out well as the definitions broadened to capture the imagination.

But how do we define resilience? There are many definitions out there, such as ability to withstand and restore, but we can agree that resilience is important to our nation’s security and economy. Break the paradigm of weather and wildfires and think broader. Resilience is a factor needed for cyber and physical security. Hardening for weather can be envisioned with higher wind standards. Hardening for cyber and physical security is complex as the attack scenarios vary and change in time.

Resilience has been and is being discussed in many states. After a big storm, there is plenty of chatter that wanes. But in recent years, initiatives have been made in typical areas where weather can be severe and broad. In earthquake-prone areas, building standards have been developed and implemented. We should do the same for the grid, with good and focused standards so that sparing can be improved for shorter restoration times.

The greater issue with resilience, however, is who pays for it and what is the real benefit? Customer expectations are rising, but they may not want the bill. Customers may add resilience themselves with back-up generators, and solar with storage, but the grid remains a necessity and we must be able to battle the storms, ice, floods, heavy snow, wildfires, and cyber and physical attacks.

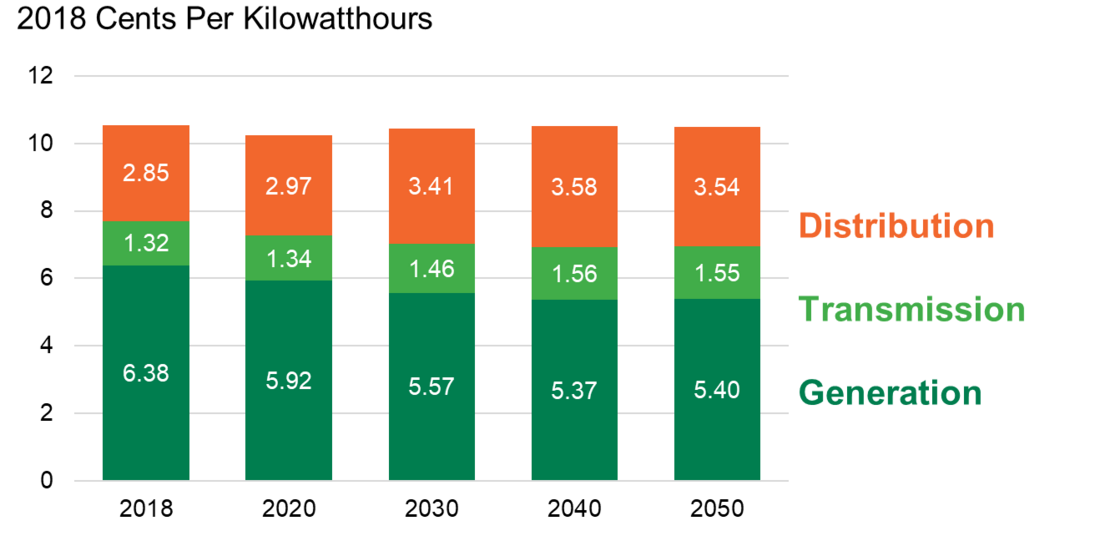

How can we afford it? The chart shows rates in 2018 dollars. The average remains about 10.5 cents/kWh but note how the bill changes. The T&D portion of the bill is rising whereas energy is a declining part of the bill. Nominally the 2050 rate is about 22 cents/kWh. The rates, however, do not cover resilience initiatives beyond the ordinary extrapolations of grid investment, and the risk for rate fatigue may be higher if energy prices rise faster than projected.

Figure 4 - Electricity prices by service category (Reference case)

We must find ways to grow to a sustainable, resilient and affordable Grid 2050. Transactional activity at the consumer level with active distribution, robust markets interconnected with robust transmission, exponential grid data analytics, and aggregations of value by third parties should lead to greater value for society and electric customers. We must find ways to break the commodity status of electricity and provide services that add comfort and security.

Place yourselves with Edison in 1879. Were his first thoughts about cost? The first light bulb cost was high including hundreds of failures. Break through the can’t do and see that light provided comfort and service to society. It was costly at first, but technology, scale, data, markets, and good American ingenuity prevailed to find lower costs and better outcomes.

I remain bullish that technology leaders, business leaders, policy makers and political leaders will find ways to transform electricity for comfort, security, sustainability, and affordability without commodity status.

As I wrote in the September 2014 T&D World article:

“Grid 2050 is foundational to the economy. Winning business models will lead the transformation. Losing business models will be nostalgically yearning for incandescence.”

About Michael Heyeck

Michael Heyeck is founder, The Grid Group LLC, and formerly senior vice president of Transmission at American Electric Power.

[All data and charts are sourced from 2019 Annual Energy Outlook reference case at EIA.gov]

Banner & thumbnail credit: Clem Onojeghuo on Unsplash