Carbon Pricing in Wholesale Electricity Markets

Due to increased concerns over climate change, many countries and jurisdictions around the world are implementing carbon-pricing schemes, mechanisms that apply a price to carbon and other greenhouse gas (GHG) emissions, to provide an incentive to reduce GHG emissions. According to the World Bank, as of 2022, there were 68 carbon-pricing initiatives implemented around the world. These initiatives span 46 national jurisdictions and 36 subnational jurisdictions and cover over 23% of global GHG emissions [1].

Members

Convenor (US)

A. GIACOMONI

P.K. AGARWAL (IN), D. ALVARADO (CL), L. AMORIM (BR), A. BELOKRYS (RU), N. BOUCHEZ (US), K. BRUNINX (NL), Q. CHEN (CN), E. DELARU (BE), B. JOSEPH (AU), T. KASHIWAGI (JP), A. KAZAGIC (BA), G. LABUTIN (RU), R. MORENO (CL), S. MUKHERJEE (IN), R. ROLDAO (PT), A. RUDKEVICH (US), N. FURTAW (US), Y. THOMAS (FR), J. WRIGHT (ZA)

Introduction

There are two main archetypes of carbon pricing: emissions trading systems (ETSs) and carbon taxes. An ETS – sometimes referred to as a cap-and-trade system – caps the total level of GHG emissions. Tradeable emissions permits or allowances are issued, facilitating cost-effective abatement: each emitter makes the trade-off between abatement or paying for an emission allowance. By creating supply and demand for emission allowances an ETS establishes a market price for emissions. The cap ensures the required emissions reductions will take place to keep the emissions (in aggregate) within the pre-allocated emissions budget. Alternatively, a carbon tax directly sets a price on GHG emissions by defining a tax rate on GHG emissions or – more commonly – on the carbon content of fossil fuels. A tax differs from an ETS in that the emissions reduction outcome is not pre-defined but the price is. The challenge for the legislator is to set the tax to an appropriate level. In an ETS, in contrast, the carbon price is determined by the market but the emissions budget is left to the discretion of the legislator.

Regardless of the mechanism used to determine the carbon price, a carbon price can have a significant impact on wholesale electricity markets. Electricity and heat production are two of the largest sources of global GHG emissions. The burning of fossil fuels, including coal, oil and natural gas, for electricity and heat accounted for over 35% of global GHG emissions in 2021 [2]. While significant investments in zero-emission resources have occurred over the last decade, according to the International Energy Agency fossil fuels still accounted for over 61% of global electricity production in 2021 [3]. As a result, putting a price on carbon and other GHG emissions can considerably alter the system dispatch over the short-term and investment decisions over the long-term.

Scope/Methodology

While other studies such as those by the World Bank [4] provide an overview of existing and emerging carbon-pricing initiatives, Working Group (WG) C5.32 was established to examine their impacts on wholesale electricity markets and the electric power sector. This Technical Brochure (TB) examines the results of a survey on carbon pricing and wholesale electricity markets developed by WG C5.32. Several questions to be addressed in this TB include the following:

- What explicit carbon prices and companion policies currently impact wholesale electricity markets in each region?

- How have the carbon prices changed over time and what were the reasons for the changes?

- How have they benefit or hurt certain supply-side resources/technologies and have they created any reliability concerns?

- What are the impacts of carbon leakage and what approaches have been taken to mitigate leakage such as border adjustments?

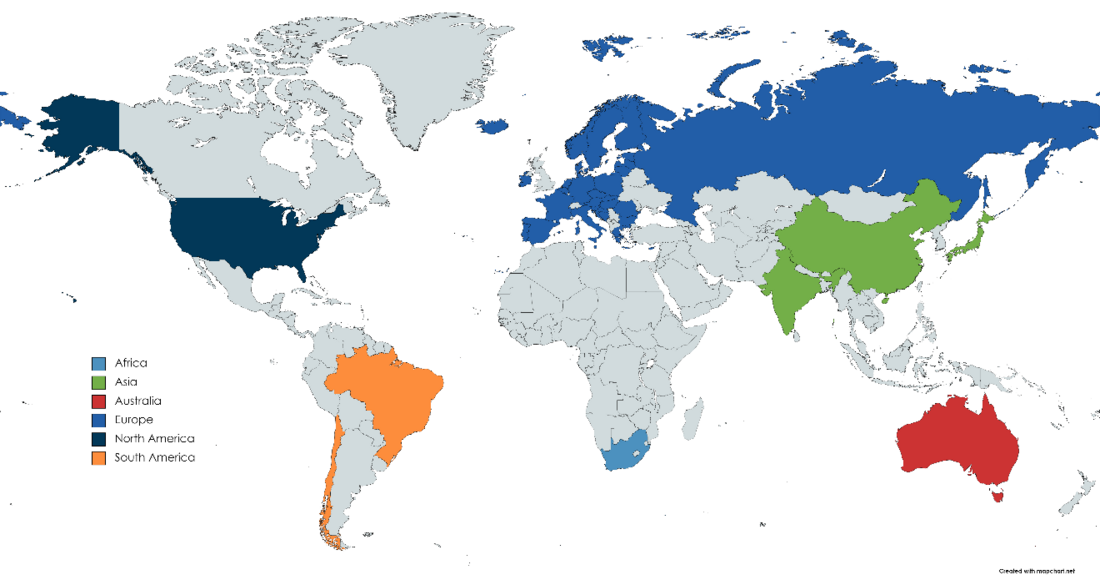

Countries and regions across all six continents were analysed including Australia, Bosnia and Herzegovina, Brazil, Chile, China, the European Union (EU), India, Japan, the Russian Federation, South Africa and the United States of America (US). Specifically, information was provided for 40 countries and 11 markets. The countries represented in the survey are shown in Figure 1. Note that individual responses were not provided for all countries in the EU.

Figure 1 - Countries that were represented in the survey

Description of the TB

The remainder of the TB is organized as follows:

Section 2: Carbon-Pricing Initiatives

For each of the 11 markets surveyed, a detailed description of the carbon-pricing initiatives that currently exist (or existed at some time in the past) that impact their wholesale electricity markets and the...