Valuation as a comprehensive approach to asset management in view of emerging developments

Especially in today’s environment for electric utilities and especially transmission and distribution companies, asset management is becoming ever more important given a multitude of investment decisions partly driven by the energy transition, and also of maintenance and end-of-life replacement decisions driven by aging assets. Project prioritization within an asset management portfolio and plan is a key challenge, given that different risks are usually measured on different scales. But asset risk can be given a monetary value when the probability and consequence of asset failure can be quantified. This monetary value of different types of asset-related risks allows these risks to be compared on a common basis, and facilitates prioritization of investments to mitigate asset related risks. Working Group C1.38 has carried out a survey on asset risk monetization practices amongst electricity industry utilities. The WG’s Technical Brochure describes areas of best practice in detail, and also topics for further investigation within CIGRE SC C1.

Members

Convenor

(AU)

G. ANCELL

Secretary

(CA)

V. WILLS

Secretary

(CA)

G. LESSARD-KRAGEN

K. ABDEL-HADI (CA), A. BURLOCK (CA), L. CHEIM (US), Z. CHENGKE (GB), D. DUNKLEY (GB), M. ELLENBOGEN (IT), G. FORD (CA), T. FROHMAJER (DE), G. HERNÁNDEZ (ES), G. MOKRYANI (GB), T. HJARTARSON (CA), J. SUCKSDORFF (DK), P. THORLEY (NZ), Y. TSIMBERG (CA)

Introduction

Modern asset management uses asset health and asset criticality to identify the need for and prioritize the replacement and maintenance of power system assets. Asset health provides an indication of an asset’s remaining life and could be linked with the associated probability of failure. Asset criticality could be used as a measure of the consequences of an asset’s failure, e.g. on uninterrupted supply of electricity. The consequences of asset failure may not only mean the end of the asset’s life but could also impact the power system and the environment where the asset is located.

Individual projects involving addition, replacement, refurbishment or maintenance of assets are typically placed within work programs where the work is prioritized against other work on assets, within the same program or against different programs. A consistent framework for valuing the risks of asset failure facilitates a more efficient portfolio of investment and a better understanding of the impact on an organization’s risk profile. Furthermore, it enables utilities to arrive at an optimal overall risk vs cost ratio at a corporate level while respecting corporate constraints, e.g. financial or labor force capabilities. Asset risk can be given a monetary value when the probability and consequence of asset failure can be quantified. This monetary value of different types of asset related risk allows these risks to be compared on a common basis and prioritization of investments to mitigate asset related risks.

Working Group C1.38 has carried out a survey on asset risk monetization practices amongst electricity industry utilities.

Methodology and progress of the work

The Working Group used the following approach to carry out the survey:

- Undertake a literature review on asset risk and risk monetisation. The review identified the topics for the survey.

- Design the survey. The specific areas for the survey were defined. This step had several iterations to develop the survey through refining questions and analyzing responses from a test group.

- Carry out the survey. This was done through a web-based survey application.

- Analyze the results.

- Identify the conclusions and opportunities for further work.

Description of the Technical Brochure

Chapter 2 gives an overview of valuation approaches. A key aspect of modern asset management is making optimal investment decisions. These decisions typically involve an assessment of the costs and benefits of the investment. The capital and operating costs for assets are usually well known. The benefits of investments are typically less well defined. This Chapter examines some approaches to valuing the costs and benefits of asset investments.

The survey design is described in Chapter 3. The survey included six sections.

- Information about the responding company used to segment results, including country, company type, ownership structure, peak demand, and whether they produce an asset management plan.

- The regulatory environment with respect to asset management documentation, application of asset management standards (i.e. PAS 55 and ISO 55000), and level of regulatory influence.

- Corporate alignment to standards (e.g. ISO 31000) and adoption of these standards into corporate strategy and objectives (i.e. risk management practices, environmental policies, health and safety, customer outreach, and reliability objectives).

- Key components of the respondent’s asset management decision-making process, including the main elements used to determine asset health and criticality, their application in the decision-making process, variance between different types of assets, and integration of asset replacement/refurbishment strategies with system expansion and O&M expenditures.

- The application of asset risk assessment and prioritization framework including asset risk valuation techniques, its application in the decision-making process, and consideration of HILP events.

- The company’s ideal future state with respect to asset management, the main challenges to achieving this state, and the most important issues to address in the short term.

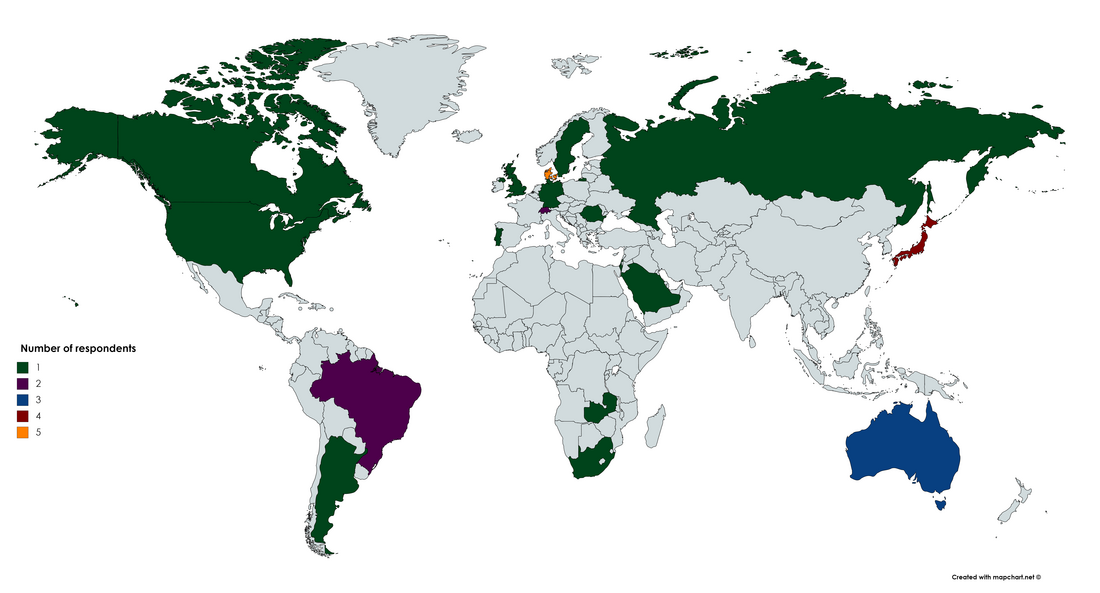

Chapter 4 outlines the survey results. Some of the results are described below. The survey was distributed to industry participants and respondents hailed from a variety of countries (see Figure 1). The company types were generally similar and largely electricity transmission and distribution (“T&D”) companies, as demonstrated by the fact that 25 out of 29 respondents operate in these sectors.

Figure 1- Map of responses

For 75% of survey respondents, the asset management plan (AMP) was an internal document at their company, with only 25% indicating that the document was available to the regulator or the general public. Corporate alignment to ISO 55000 tends to be a key driver for creating an internal AMP.

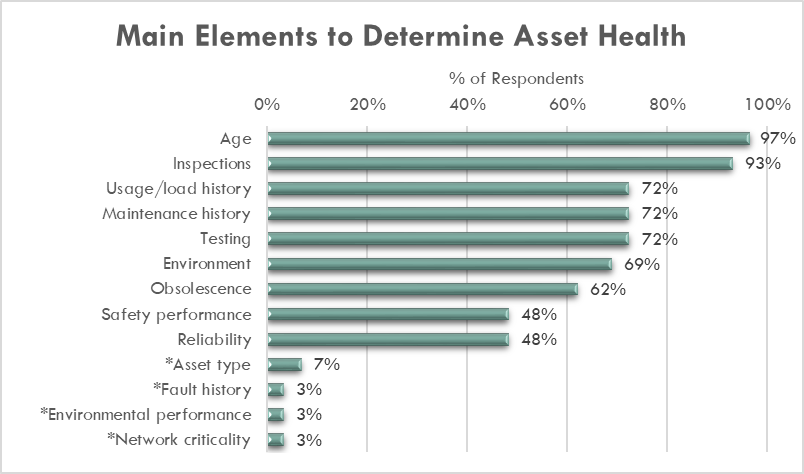

One survey question concerned what elements utilities used to determine asset health (see Figure 2).

Figure 2 - Asset health elements

Almost all respondents use age to determine asset health, supplemented with inspection results in most cases, demonstrating that age is a readily available parameter that is associated with asset health worldwide. Almost two thirds (62%) of respondents consider more than five factors when determining asset health.

70% of respondents with an AMP also have a numerical health index, meaning a company that documents its AMP is more likely to have a methodology to quantify asset condition than one which does not.

Discussion of the results is given in Chapter 5.

Chapter 6 sets out the conclusions made by the working group and provides recommendations for future work. The appendices contain the complete survey results, a list of the members of the working group and a table of definitions.

Conclusions and main learning points

72% of organizations are using risk in the early stages of investment decision making to identify asset candidates for replacement or refurbishment.

Organizations in the industry are most commonly using risk for budgeting and prioritizing capital projects.

Similarly, 21% of respondents reported full integration between their planning processes for capital and O&M investments. Of this subset, 83% have developed an AMP, meaning companies with an asset management plan are more likely to integrate their capital and O&M expenditures.

Almost all survey respondents (93%) consider asset criticality as part of their decision-making process, mainly considering risk in the context of the system, safety, financials, environment, and customers.

For 75% of survey respondents, the AMP was an internal document at their company, with only 25% indicating that the document was available to the regulator or the general public.

Identified areas of best practice include:

- ISO 55000 Alignment/Certification;

- Utilization of Shared Frameworks for Decision-Making;

- Combination of Long-Term and Near-Term Needs Analysis;

- Monetization of Asset Risk;

- Establishment of Decision Frameworks Early in Process;

- Online Monitoring of Asset Health;

- Commitment to Continuous Improvement.

The followng areas are suggested for future CIGRE work.

Quality, quantity, and availability of data

Future work from CIGRE could center around best practices for data collection strategies, and how to assure that the right data is being collected for the task at hand (in our case, risk and condition assessment). The future work could also examine different technology innovations and trends in this field, and how providers could improve their data collection and management.

Refinement of asset condition assessment methodologies

An opportunity for future investigation could be to determine a standard (e.g. CNAIM) or best practice for condition assessment for different asset classes, or at the very least identify and educate the industry on what is currently being done.

Process automation for condition assessment and risk analysis

CIGRE may want to pursue more studies around best practices in automation of these processes, and how different industries and regions are attempting to bridge those gaps.

The new Working Group C1.43 “Requirements for Asset Analytics data platforms and tools in electric power systems” will address some of these issues.