Introduction of Real Time Market in India – An Experience

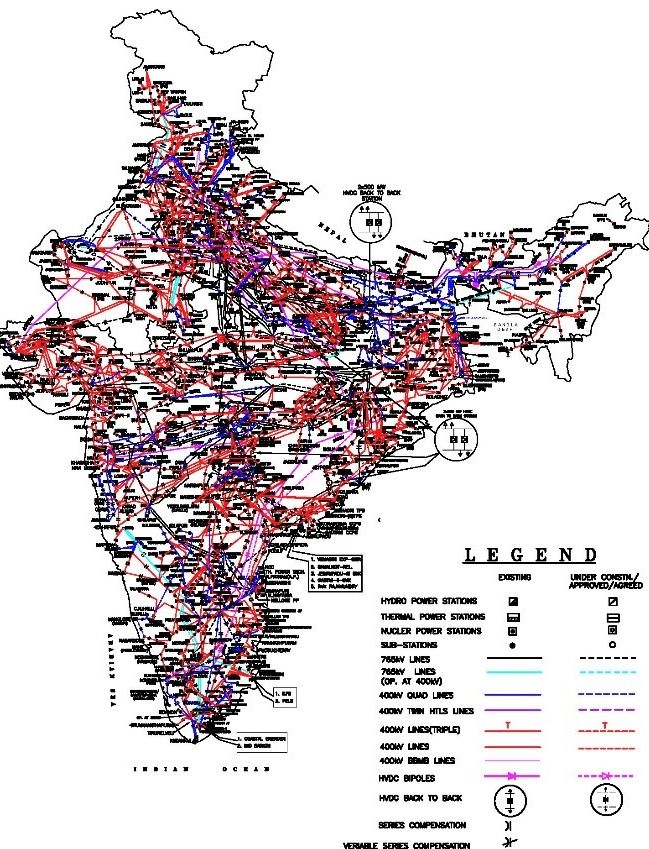

The Indian grid is one of the worlds’ largest synchronous national grids with an installed generation capacity of 382 GW (including 140 GW of renewable and hydro), 255375 circuit kilometres of transmission system (400 kV and above and HVDCs) and serving a peak demand of about 190 GW.

by KVS Baba, SS Barpanda, Debasis De, SC Saxena, Gaurav Verma

Power System Operation Corporation Ltd. (POSOCO)*

Figure 1 - Indian Electricity Grid (Source: CEA)

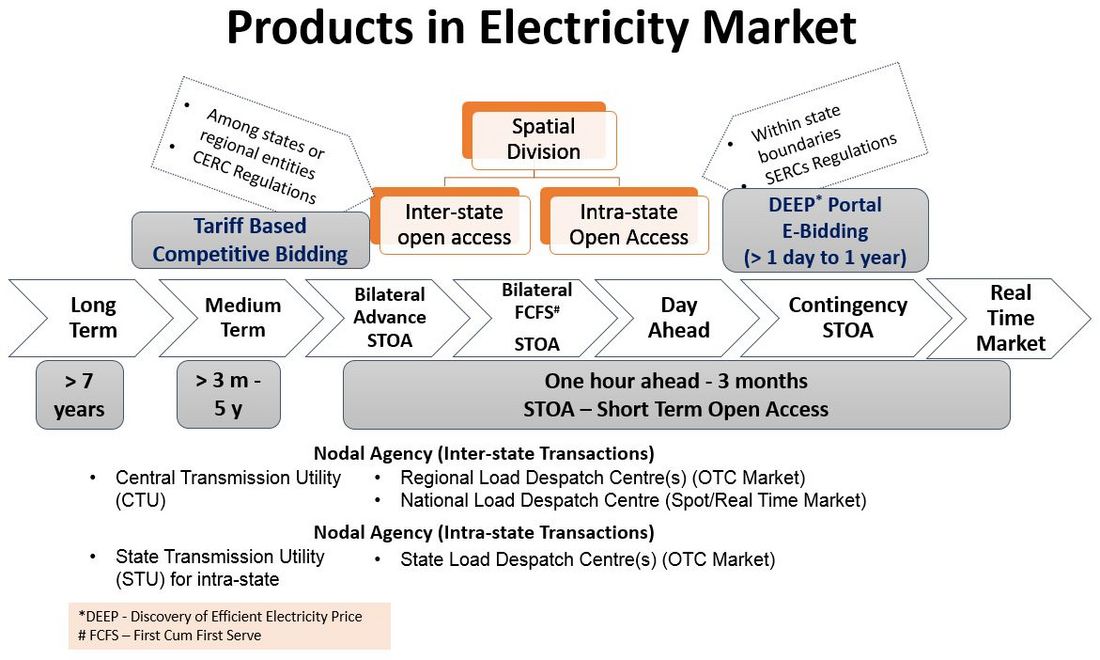

Electricity trading through Power Exchanges was introduced in India in 2008 as an hourly market and sub-hourly market (15-minute) was introduced in 2012. There are two operational Power Exchanges where price discovery takes place and the National Load Despatch Center (NLDC) approves the trades depending on the available transmission margins.

Various products are available in different timeframes in the Indian electricity market (Figure 2) which comprises of about 90% of tied up in long-term contracts, about 9% in short term market (OTC and Power Exchanges) and balance through deviations.

Figure 2 - Products in Indian Electricity Market

Motivation for introduction of Real Time Market (RTM)

Government of India has set an ambitious target to achieve 175 GW capacity of renewables by 2022. The present penetration levels are about 15% of all India daily energy consumption. It has created a challenge of maintaining the system in balance specially for the renewable-rich states. Inadvertent deviations during real time were primarily being taken care through imbalance mechanism and tertiary ancillary services. After closure of the day-ahead market, limited opportunities in the form of day-ahead & contingency bilateral contracts were available to market participants to re-balance the portfolio closer to real time.

Regulatory Framework and Procedures

Central Electricity Regulatory Commission (CERC) provided the regulatory framework for Real Time Market (RTM) in December 2019 through amendments to:

- (a) Indian Electricity Grid Code

- (b) Open Access in Inter-state transmission Regulations

- (c) Power Market Regulations

The detailed procedures for scheduling of collective transactions through RTM was issued by NLDC in May 2020 after nationwide stakeholder consultations.

Salient Features of RTM

Pan India RTM was implemented from 1st June 2020 which has enabled participants access to electricity market just one hour before delivery. Vision and motivation behind the introduction of RTM in India was to bring in vital flexibility to manage real-time balance while ensuring optimal utilization of the available resources in the system.

A double-sided closed auction has been adopted with social welfare maximization as the objective function for price discovery. RTM is a half-hour physical delivery-based market with 48 daily trading sessions. Post Gate Closure (end of trading session), 15 minutes have been allocated for RTM clearing by NLDC and results communicated to market participants 45 minutes prior to delivery. RTM transactions are physically and financially binding.

In-house Implementation of RTM during COVID-19 Pandemic

Implementation of RTM Pan-India within a six-month period of notification of CERC Regulations in December 2019 was a challenging task considering the multi exchange scenario. Further, with effect from the last week of March 2020, restrictions were put in place when the country went into lockdown on account of the COVID-19 pandemic. Considering the pandemic situation, the go-live date was deferred by CERC from 1st April 2020 to 1st June 2020.

Considering the COVID-19 restrictions the implementation team at NLDC worked remotely for development of an in-house web based fully automated RTM transactions processing software ensuring secure API based information exchange with the Power Exchanges.

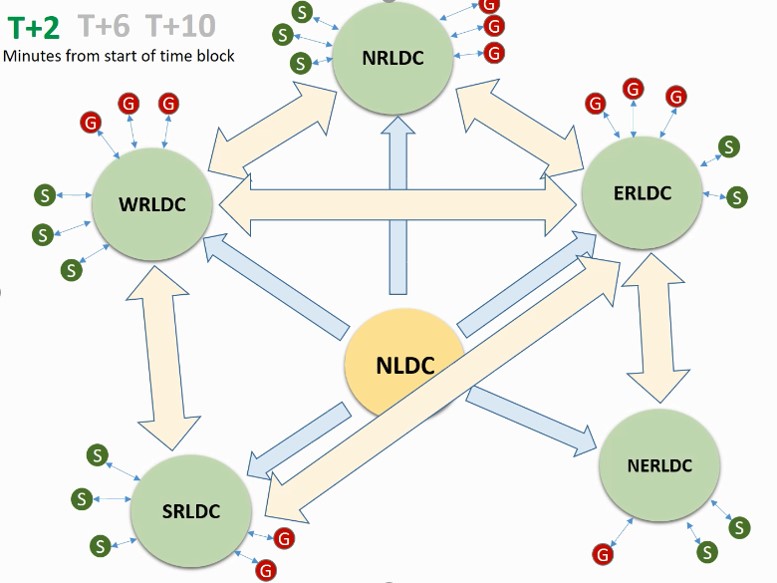

Another team of system operators across National and Regional Load Despatch Centres (NLDC/RLDCs) played a vital role in upgrading the Web Based Energy Scheduling (WBES) Applications in different RLDCs to compute the available transmission margins in real time to facilitate the clearing of the Real Time Market (RTM). WBES and RTM applications were integrated, and Figure 3 shows the schematic of synchronization of available transmission margins and schedules across RLDCs within a time block. Most of the development activities for a fully automated system and testing were carried out remotely within NLDC/RLDCs and with the Power Exchanges.

Figure 3 - Synchronization of WBES across RLDCs

Complexity arises on account of allocation of available transmission margins between multiple Power Exchanges and CERC provided the methodology for sharing of transmission margins amongst the Power Exchanges based on the unconstrained volumes in the respective Power Exchanges in May 2020.

Robust communication is ensured through redundant dedicated communication links between each Power Exchange and NLDC with internet as a third link in extreme cases.

RTM go-live occurred on 1st June 2020 and was dedicated to the nation by the Hon’ble Power Minister (Figure 4).

Figure 4 - Media Coverage of launch of RTM

Experience of RTM

Internationally, continuous auctions are used in real time markets considering liquidity. In India, a double-sided closed auction with uniform price discovery has been implemented.

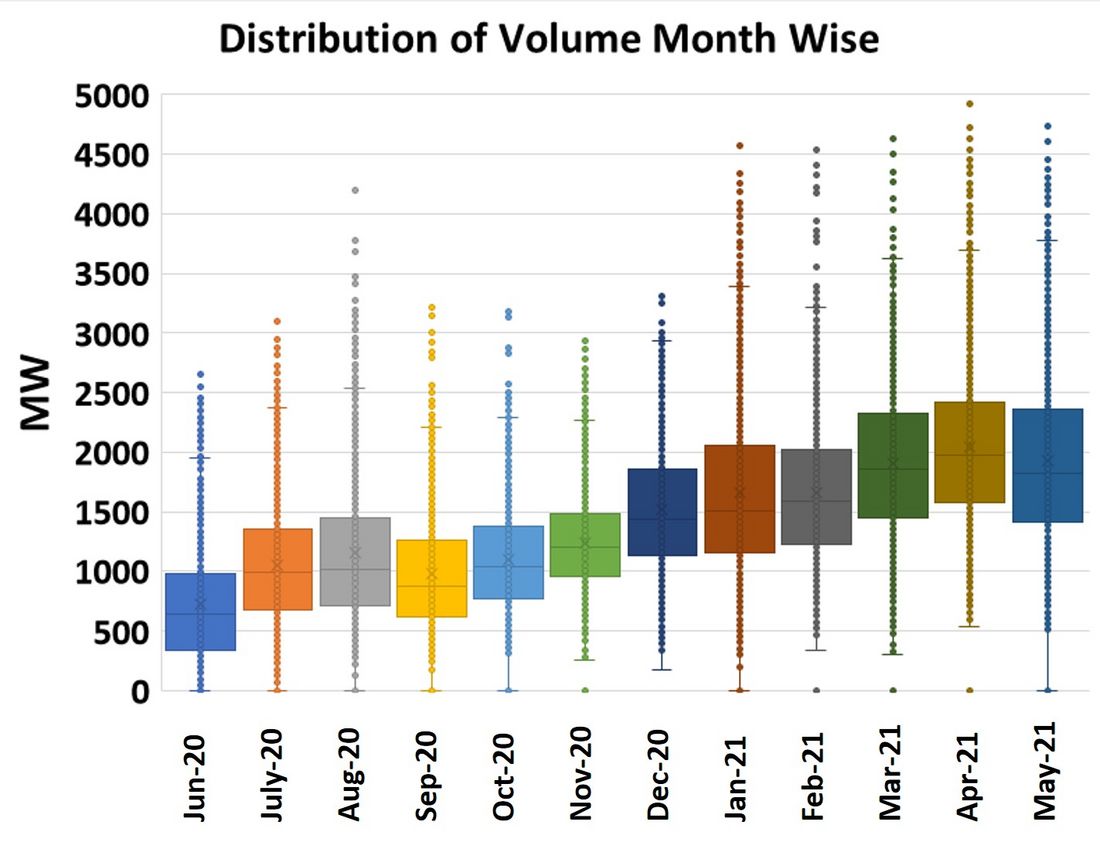

Figure 5 - Month wise distribution of volume in RTM

RTM volumes have picked up and maximum trade in any time block was more than 5000 MW achieving a maximum of about 74 GWh in May 2021 (Figure 5).

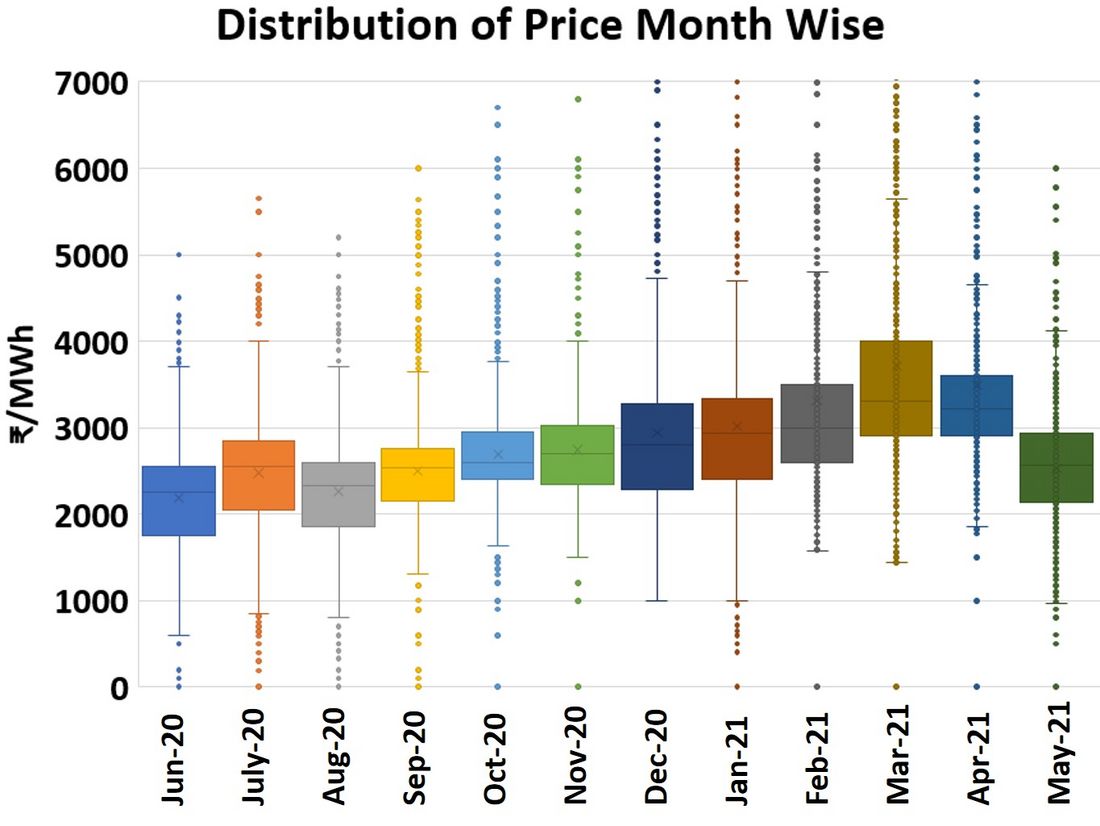

Figure 6 - Month wise distribution of MCP in RTM

During the first year of operation, the minimum and maximum market-clearing price was ₹15 (USD 0.21) per MWh and ₹10500 (USD 150) per MWh respectively (assuming 1 USD=₹70) with average of ₹2830 (USD 40.43) per MWh (Figure 6).

RTM has helped to integrate renewables in an effective way. Distribution companies (DISCOMs) can manage the challenge of intermittency associated with renewables and the need for balancing is being facilitated just one hour ahead of delivery. The generators have additional opportunity to sell their surplus generation. RTM provides an avenue to generators for meeting supply obligation through purchase of power in case of forced outages.

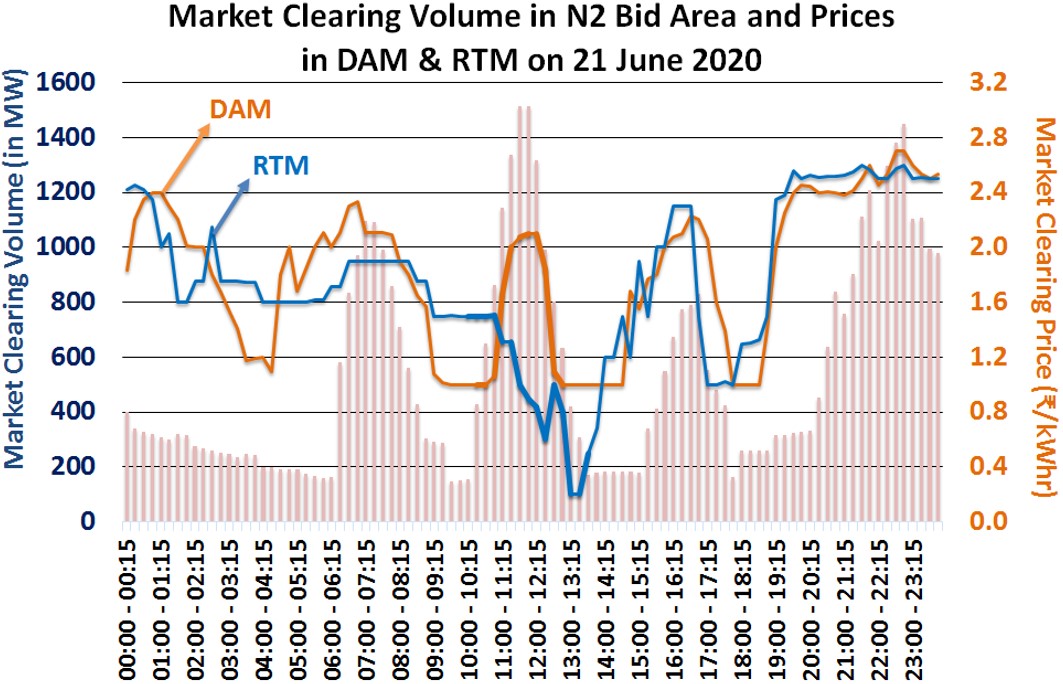

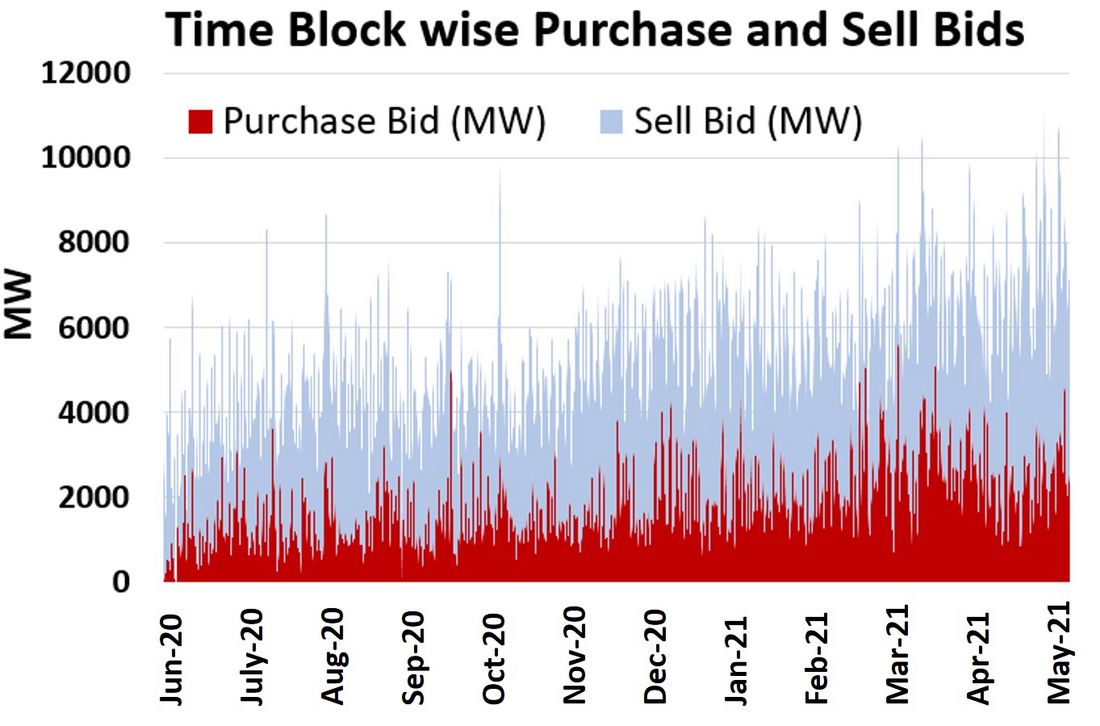

Figure 7 shows the use of Day-Ahead Market (DAM) and RTM during Solar Eclipse. Liquidity (Figure 8) during the first year of RTM shows supply has been higher than demand in most periods.

Figure 7 - Market behaviour during Solar Eclipse

Figure 8 - Volume of Buy bids and Sell bids

Average daily volumes in RTM have picked from around 10% in June 2020 to around 25-30% of volume cleared in DAM.

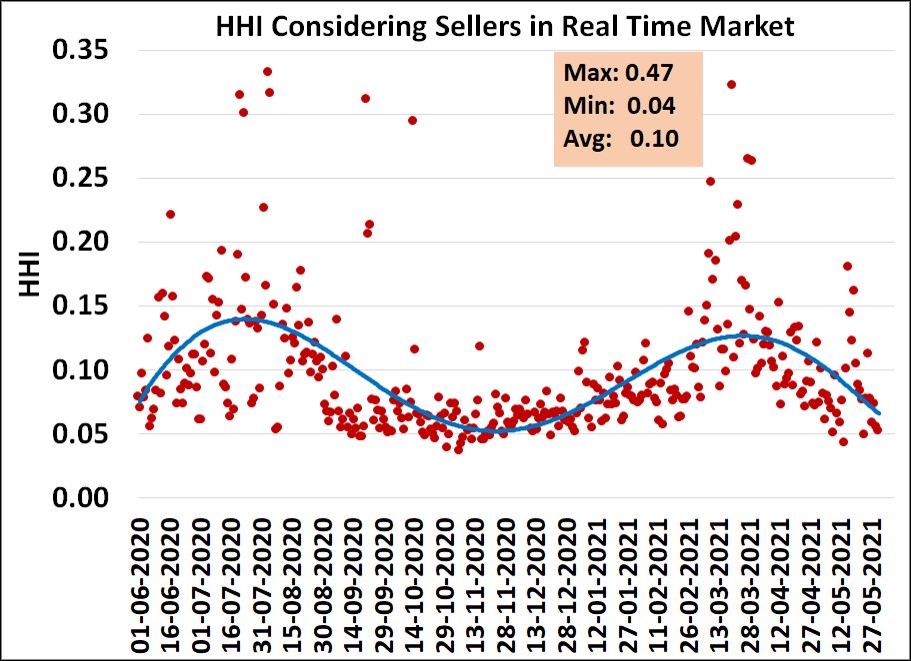

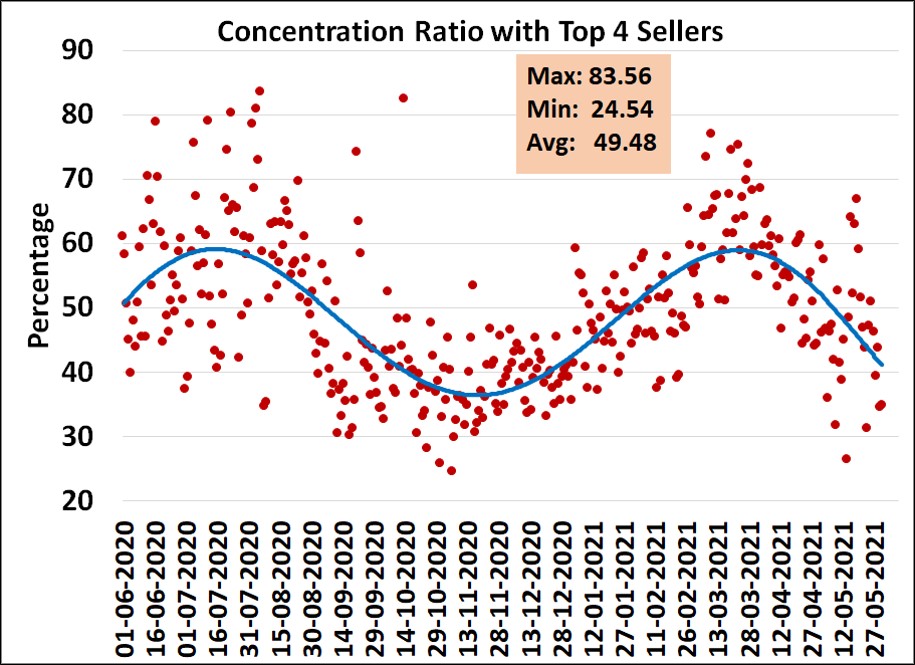

The Herfindahl-Hirschman Index (HHI) for sellers (Figure 9) is in the range 0.05 to 0.15 and the four firm concentration ratio (Figure 10) is of the order of average 50% showing healthy competition amongst sellers.

Figure 9 - HHI for sellers in RTM

Figure 10 - Concentration ratio with top 4 sellers in RTM

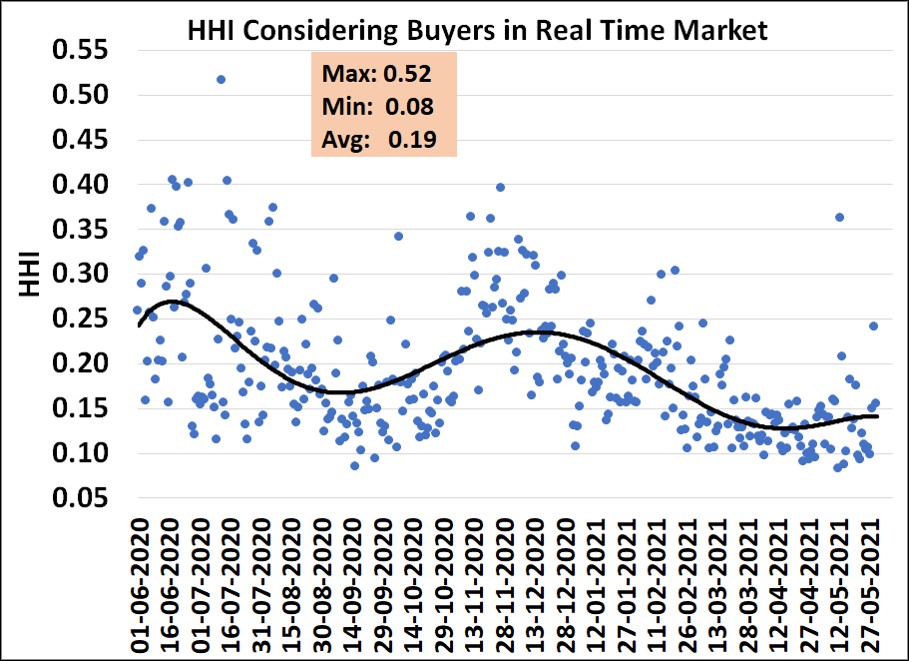

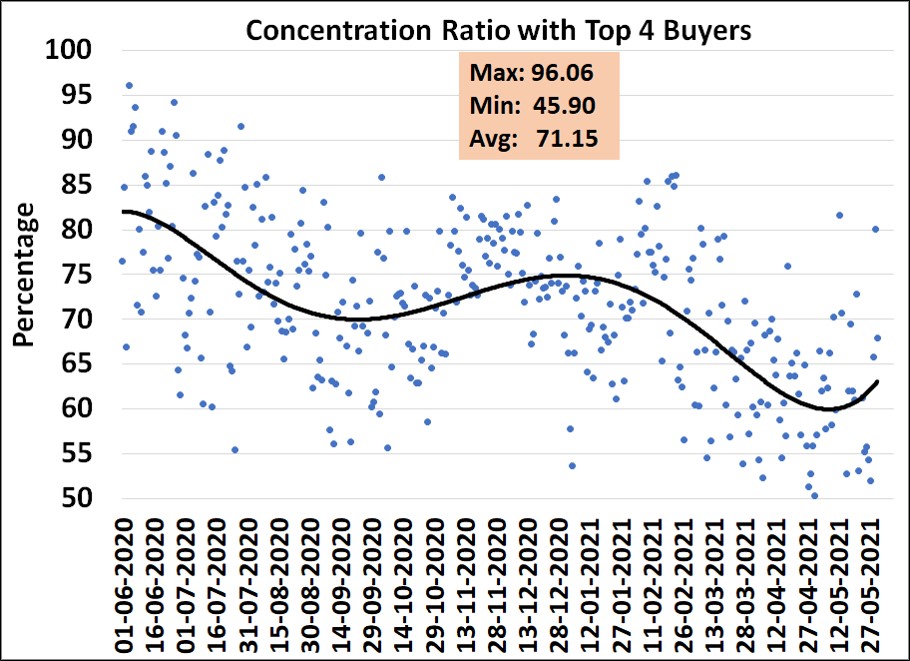

HHI for buyers (Figure 11) is in the range of 0.15 to 0.25 and four firm concentration ratio (Figure 12) is around 70% indicative of oligopolistic market for buyers.

Figure 11 - HHI for buyers in RTM

Figure 12 - Concentration ratio with top 4 buyers in RTM

Conclusion and Way Forward

Guided by the policy initiatives of the Ministry of Power and regulatory framework provided by CERC, RTM has been introduced in India during the COVID-19 lockdown period and has been a success story.

Coordination involving POSOCO as the System Operator, Power Exchanges and stakeholders for integration, testing and commission has been carried out through remote working.

RTM has provided an avenue to buyers and sellers to manage their power requirements in the efficient & competitive manner closer to the time of despatch.

Volumes in RTM have shown an increasing trend indicating improved liquidity and participation in the RTM. Further, RTM has also provided a market segment with low transaction costs as compared to bilateral segment (day-ahead / contingency).

POSOCO is the system operator (ISO) at national level in India.

Thumbnail credit: Photo by loveguli on iStock