Overview of International hydrogen strategies study

Hydrogen plays an important role in a future energy system. The analysis of government action for hydrogen in the national scale shows that the main drivers are the Greenhouse Gas (GHG) emission reduction goals, the integration of renewables, as well as the opportunity for economic growth and energy supply diversity. While national strategies obviously differ in detail, reflecting particular country interests and industrial strengths, there is a clear, strong, and lasting international momentum behind the universal recognition that hydrogen is an essential and indispensable element of a decarbonised energy system.

By Olga Sudarikova & Olga Frolova

Introduction

The 2020 and 2021 reports from World Energy Council overview national hydrogen strategies, including hydrogen technologies and applications support measures, and consider the sectoral priorities and regional aspects.

This summary covers main national goals (decarbonization, diversified energy supply, fostering economic growth, integration of renewables) and highlights the key spheres of hydrogen adoption (such as industry and transportation).

National goals & support measures. Technologies & applications

Considered hydrogen strategies can be expected to cover countries representing over 80% of global GDP by 2025.

Asia and Europe currently seem more demand focused, while the Middle East and North Africa are more supply focused. Asia shows a greater focus on hydrogen as a liquid fuel in the form of ammonia and as a transport fuel for shipping and road transport. Japan has been actively seeking to establish international supply chains, while Korea has focused on new technologies such as hydrogen fuel cell vehicles.

In contrast, Europe is more focused on using hydrogen to decarbonise the hard-to-abate sectors in industry and transport (heavy duty – for example, buses and lorries). The Americas (North and South) are considering production for their own consumption and export.

Among the studied countries, key national goals are clean energy (GHG emission reduction, integration of renewables), secure energy supply (diversified energy supply, develop hydrogen for export) and economic growth (foster economic growth, creating new jobs, strengthening the national technological development).

Several national strategies highlight jobs as an important driver behind hydrogen development, either to safeguard existing jobs through re-purposing current hydrocarbon infrastructure or capturing carbon emissions, or create new jobs in the new hydrogen economy.

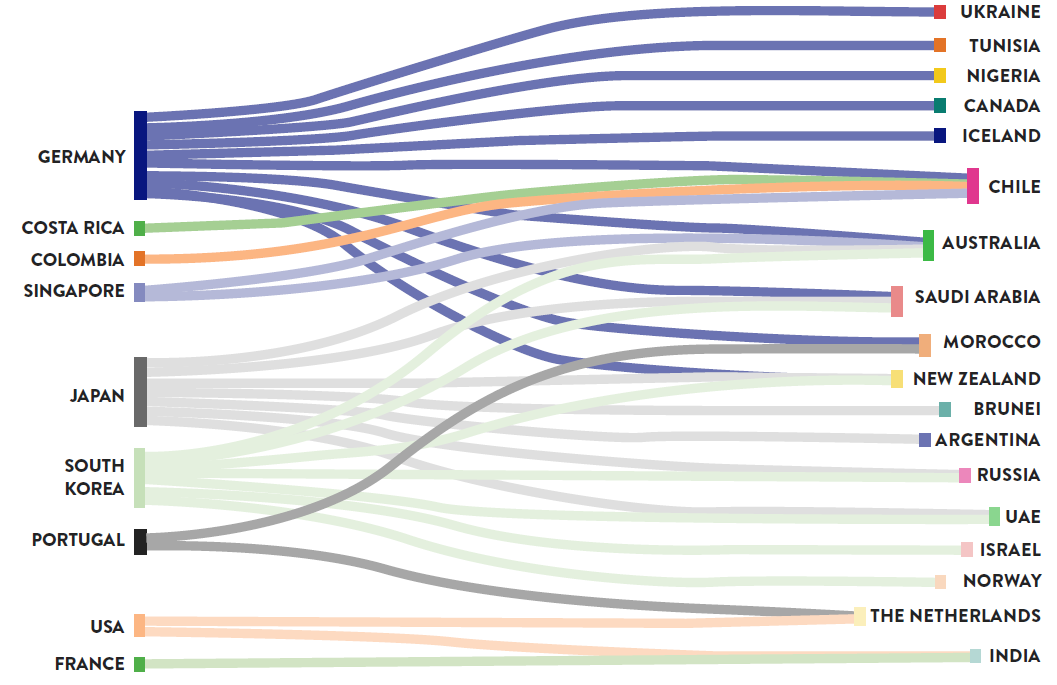

Outside national territories, some countries are actively developing bilateral partnerships to help form global hydrogen supply chains and secure clean hydrogen supply (see Figure 1).

Figure 1 - Bilateral partnerships

- Source: Hydrogen on the horizon: ready, almost set, go? World Energy Council in collaboration with EPRI and PwC, July 2021

It’s noted that the supply chains in this case will gain from a close integration with major stakeholders covering production, infrastructure, and logistics. Such partnerships are already being formed.

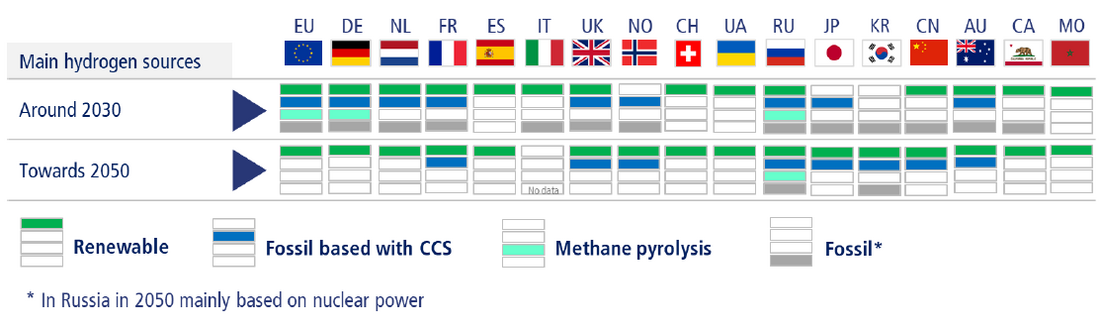

Among sources of hydrogen production are (see Figure 2):

- hydrogen from water using renewable electricity (e.g. from wind and solar energy);

- hydrogen from biomass labelled as ‘renewable hydrogen’, but generally with a larger carbon footprint;

- fossil-based hydrogen with CCS technology as well as hydrogen from methane pyrolysis associated with a low carbon footprint;

- hydrogen from fossil feedstock for natural gas reforming or coal gasification without CCS (dominating today’s hydrogen production).

Today, there is no internationally agreed terminology or carbon-intensity limit for the categorizing hydrogen production options.

Figure 2 - Sources of hydrogen production - Source: International hydrogen strategies. A study commissioned by and in cooperation with the World Energy Council Germany, September 2020

In the medium-term (around 2030), renewable and fossil-based hydrogen (with and without CCS) are generally considered viable options by most countries.

Looking at 2050, over half of the countries analysed focus on using green hydrogen sourced from renewable energy only. Other types low carbon hydrogen are seen as an effective and pragmatic way to ramp up volumes in the interim.

Moreover, the expected development of the green hydrogen market can be differentiated in three phases: market activation will help to transform current demonstration into an early market (phase 1), which is expected to subsequently experience sustainable growth (phase 2), eventually leading to a large and well-established market by 2050 (phase 3).

The main sectors of national strategies include transport and industry. In countries with a strong industrial sector and a high priority on GHG reduction the latter one is preferable. For transport applications, most strategies do not differentiate strongly between using hydrogen directly and converting it into other synthetic fuels.

The expected use of hydrogen in fuel cell passenger vehicles and trucks is stronger in Asia than in Europe. While Japanese, Korean, and Chinese plans foresee a relevant role of fuel cell electric vehicles in all road transport sectors, European strategies mainly focus on heavy goods vehicles.

Green synthetic fuels are mentioned as an option for aviation and maritime shipping. These fuel types may be used in the existing engines without major modification; they provide a short term perspective for decarbonisation, whereas a direct hydrogen use is seen as a potential long-term solution, requiring a more profound technology development and longer lead time.

Conclusion

Hydrogen plays an important role in a future energy system.

The analysis of government actions for hydrogen in the selected countries shows that the main drivers for these authorities are the GHG emission reduction goals, the integration of renewables, as well as the opportunity for economic growth. While national strategies obviously differ in detail, reflecting particular country interests and industrial strengths, there is a clear, strong, and lasting international momentum behind the universal recognition that hydrogen is an essential and indispensable element of a decarbonised energy system.

A very important issue raised is “hydrogen colour”. It’s underlined, that colour has been used to simplify the conversation about the carbon footprint of hydrogen production, but it has become more complex with no universally agreed colours for specific technologies and some disagreement as to which colour matches which supply. The proposed solution according to research is moving beyond colour and instead focusing on carbon equivalence.

Over half of the analysed countries focus on using green hydrogen sourced from renewable energy only up to 2050. Other types of low carbon hydrogen are seen as an effective and pragmatic way to ramp up volumes in the interim.

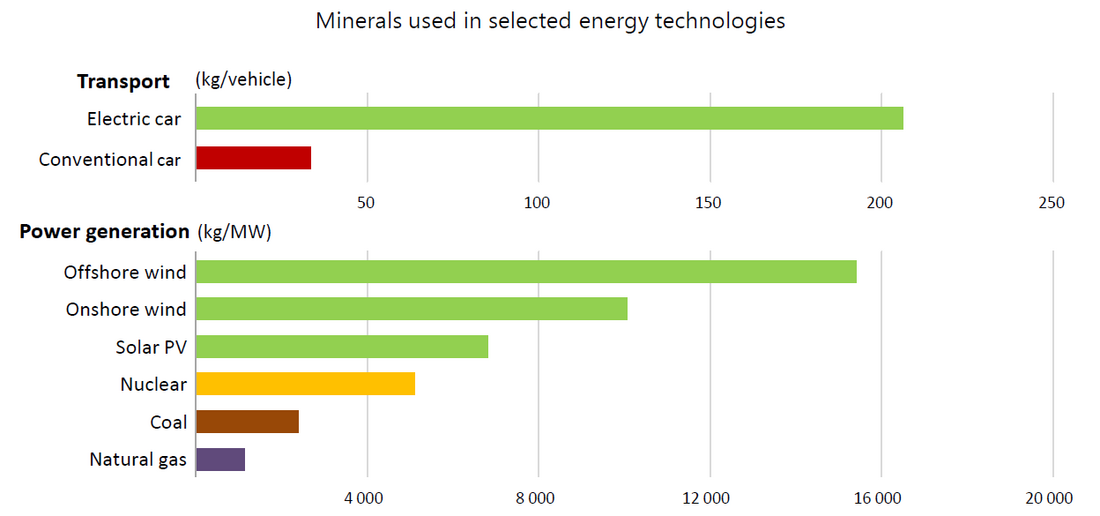

To achieve this ambitious goal, it is necessary to point out, that according to IEA data (see Figure 3), the applications and technology based on clean energy and decarbonization are extremely mineral intensive. The mineral intensity of clean energy technologies may accelerate demand by as much as 4 to 6 times, depending on the technology. A typical electric vehicle (EV) requires 6 to 8 times more mineral inputs than a conventional, internal combustion engine vehicle. An EV requires 60 to 83 kilograms (132 to 183 pounds) of copper, compared with a conventional car which requires only 15 kilograms (33 pounds). Meanwhile, a single, fully-electric bus requires a whopping 370 kilograms (816 pounds) of copper. By 2030, it is estimated that total demand for copper from EVs and associated infrastructure could be as high as 2.6 to 3.2 million tones (7.1 billion pounds) or approximately 13-15% of 2020 global supply.

Figure 3 - Minerals used in selected energy technologies - Source: The Role of Critical Minerals in Clean Energy Transitions. IEA. World Energy Outlook Special Report

Thus, the world will inevitably be faced with rapid demand for critical minerals such as copper, lithium, nickel, cobalt, and rare earth elements, which in turn could be subject to price volatility, geopolitical influence, and even supply disruptions.

It will be necessary to take into consideration these concerns and actively strengthen international cooperation without harming the environment and taking into account the UN SDG.

Sources

- International hydrogen strategies. A study commissioned by and in cooperation with the World Energy Council Germany, September 2020 https://www.weltenergierat.de/wp-content/uploads/2020/09/WEC_H2_Strategies_finalreport_200922.pdf

- Hydrogen on the horizon: ready, almost set, go? World Energy Council in collaboration with EPRI and PwC, July 2021 https://www.worldenergy.org/publications/entry/innovation-insights-brief-hydrogen-on-the-horizon-ready-almost-set-go

- The Role of Critical Minerals in Clean Energy Transitions. IEA. World Energy Outlook Special Report https://www.iea.org/reports/the-role-of-critical-minerals-in-clean-energy-transitions

- Green Hydrogen Cost Reduction: Scaling up Electrolysers to Meet the 1.5⁰C Climate Goal, IRENA, 2020 https://www.irena.org/-/media/Files/IRENA/Agency/Publication/2020/Dec/IRENA_Green_hydrogen_cost_2020.pdf

- Russia: strategy to hydrogen energy transition. B.N. Kuzyk, Yu.V.Yakovets. 2007.

Banner & Thumbnail credit: Photo by Pawel Czerwinski on Unsplash