Utility Scale Battery Storage in the Australian National Electricity Market

by Jonathon Dyson

Introduction

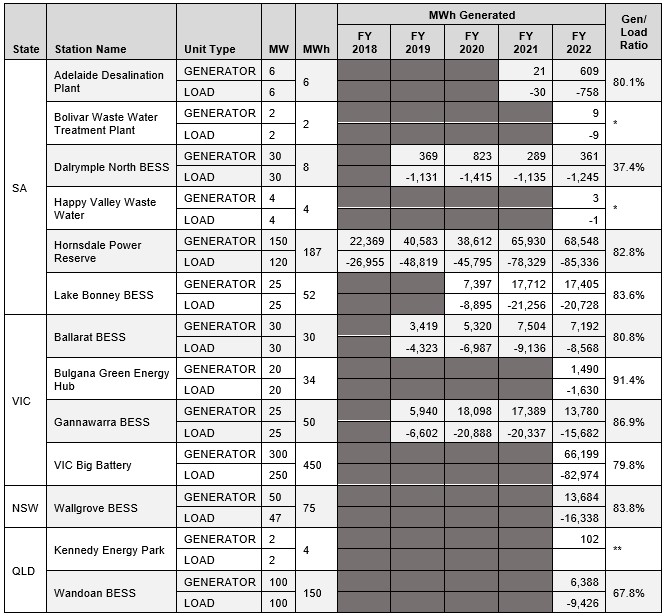

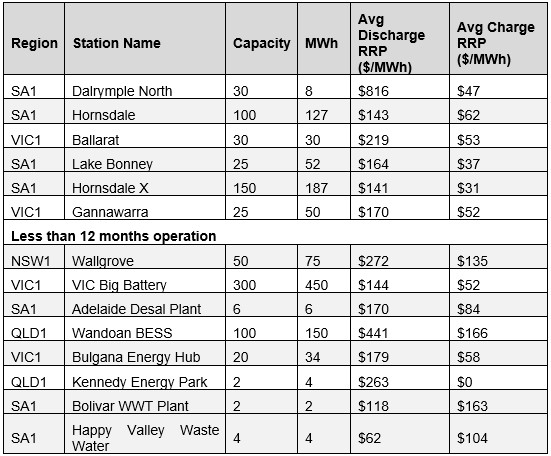

One of the most exciting developments within the Australian National Electricity Market [1] (NEM) in the past 5 years has been the deployment of utility-scale Battery Energy Storage Systems (BESS). The currently registered and operating BESS are listed below, along with annual MWh energy discharge, charge, and average discharge/charge ratio.

Table 1 - Registered BESS in the NEM and MWh Generation (and Consumption) (as at 1 Jul 2022)

Table Notes:

* Both small BESS are connected to local distribution points which may not be metering all consumption.

** KEP uses some wind and/or solar to charge the BESS, which is not separately captured.

Several key items from Table 1 are important:

- BESS are a net load on the system – they generally consume more power than they discharge, with a consistent range in the order of 80-85%. Loads in the NEM show as a negative number.

- The Dalrymple BESS consumes far more energy than it discharges (up to double the other facilities) although, as later information will show, it captures nearly 100% of its revenue from ancillary services, hence energy arbitrage is only a minor operating driver.

- The annual energy charge/discharge ratios would indicate that some of the NEM BESS are utilised more than 1 cycle per day, and some up to two cycles per day

- As the BESS systems get larger, there is a difference between the maximum discharge capacity and charge capacity

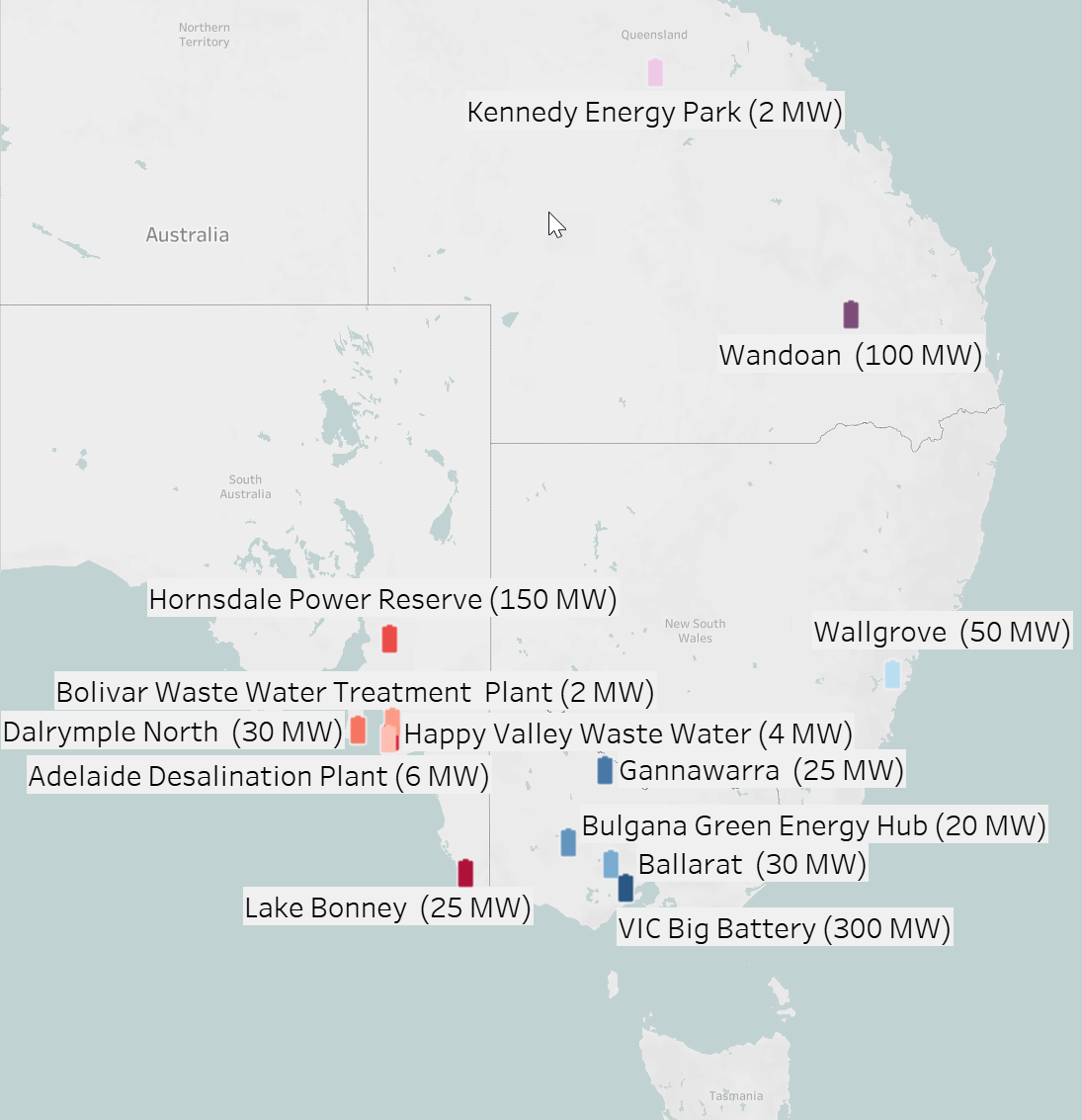

Each BESS is geographically shown below in Figure 1 with most sites located in the southern regions of Victoria (Vic) and South Australia (SA), although the last 12 months has seen additional BESS commissioned in New South Wales (NSW) and Queensland (Qld).

Figure 1 - BESS Sites in the NEM

Other than Kennedy Energy Park, none of the large-scale BESS are hybrid power plants or hybrid generating facilities. Many are co-located next door to renewable facilities, but all effectively consume their generation from the grid in a similar fashion to any other customer on the grid. This is an important design and business case element for future BESS items.

The benefits of Storage

The NEM is leading the global trend in shifting electricity generation from fossil fuels towards Variable Renewable Energy (VRE) resources including wind, utility (grid-connected) solar, and DPV (distributed solar PV). Within that changing landscape of supply, a number of key factors are required, not the least being suitable market structures that allows for price volatility (for charge/discharge arbitrage), ancillary service payments (effectively a small capacity payment or a critical system function) and where applicable, payments for network support/system services.

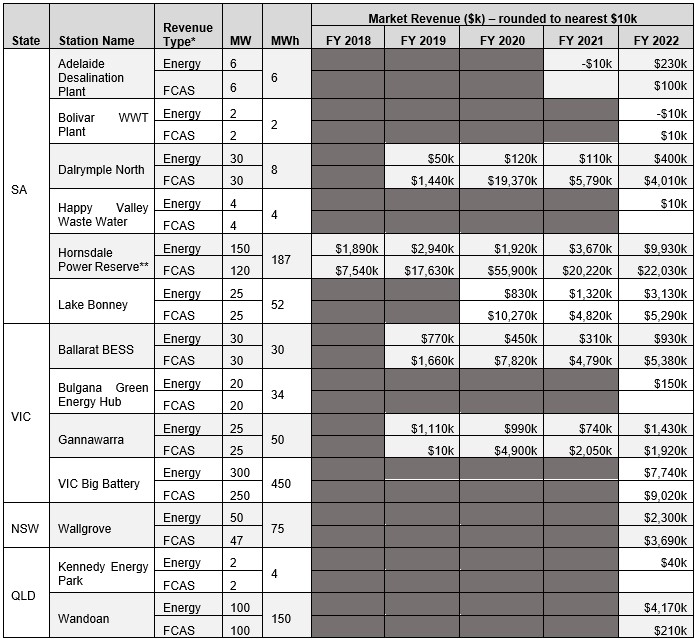

Most of the commissioned BESS in the NEM have been setup to be available in the Frequency Control Ancillary Services (FCAS) markets, a series of co-optimised primary and secondary frequency control elements with energy. Table 2 below shows recent annual market energy and FCAS revenue.

Table 2 - Registered BESS in the NEM and Net Energy& FCAS Revenue (as at 1 Jul 2022)

Table notes

* Total revenue includes the cost of charging the BESS where applicable

** Hornsdale was upgraded in mid 2020 to 150MW/187MW from 100MW/127MWh. In the following tables the upgrade is denoted with Hornsdale X

The revenue costs shown above do not include the proportionally small FCAS costs associated with NEM generation, be that FCAS contingency cost allocation or causer pays. Similarly, additional network payments and/or contracted positions are not included. Further detail is available for those that may be interested.

As more VRE is integrated into the grid, more generation variability and price uncertainty is expected to occur, changing the behaviour of the overall system and thereby changing the business value equations for BESS. The ability of the BESS facilities to capture very low (or negative) market prices because of high VRE is a compelling business value aspect over conventional gas and hydro assets, and we see this contributing a significant element of the business value stack for BESS facilities.

Overall BESS Performance

Each of the BESS deployed in the NEM have been set up with slightly different technical configurations and capabilities, in different parts of the network to meet different requirements. Each have been developed with unique funding arrangements as well. At present, all NEM BESS have had some form of subsidy (be that Federal agencies, state governments or local transmission arrangements), although it is expected in coming years that future developments may be financed in a stand-alone manner.

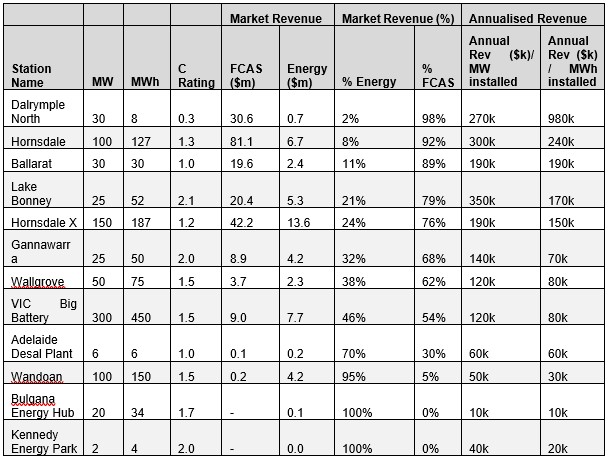

Table 3 below contains several key financial and operational metrics that highlight the impact various setups and configurations can have on the facility and eventual estimated annual financial performance.

Table 3 - Basic Metrics for NEM BESS (to 1 Jul 2022) – ordered on high to low % FCAS

Table 4 below highlights one of the most important drivers of BESS business cases: the differential between charge and discharge.

Table 4 - Avg Charge and Discharge RRP throughout Operations (up to 1 Jul 2022)

The metrics in Table 3 and Table 4 show that:

- Each of the operating BESS have different revenue focus, some as high as 98% from FCAS (Dalrymple North), whereas Gannawarra (which is co-located with Solar and within a wider Energy Australia portfolio) has a much lower benefit from FCAS

- The more recent BESS installations are yet to be fully utilised in FCAS, with Wandoan only recently registered for FCAS (and Bulgana is yet to be registered).

- The Vic Big Battery (VBB) has special protection scheme requirements that were enabled across the NEM summer period, hence it is yet to do a full year of service

Nearly all of the BESS (once past commissioning) are operating with RRP differentials greater than $100/MWh, with an average of approximately $160/MWh.

Using BESS to support the electricity grid

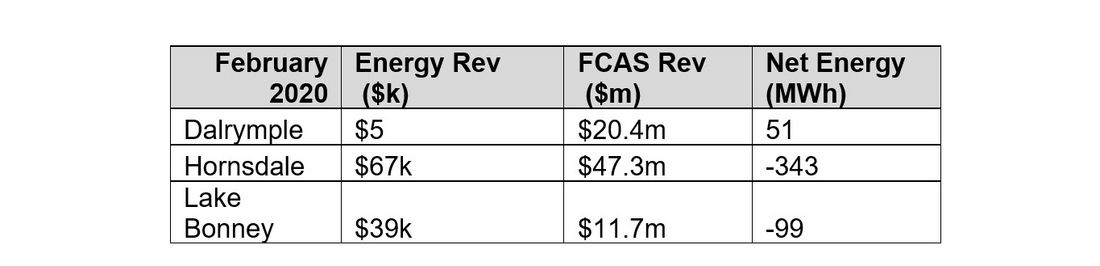

Although the above metrics are very useful to understand high level operational and business case elements over multiple years, a very compelling operational use case for BESS deployment came in February 2020, when a major 600MW interconnector suffered an unplanned outage between Victoria (VIC1) and South Australia (SA1).

In the ensuing 3-week outage period, all the operational BESS in SA1 (Hornsdale, Lake Bonney and Dalrymple) were constrained to 0MW for energy arbitrage, but their FCAS was allowed to be fully dispatched. This effectively resulted in all the SA BESS entering standby or frequency-only support mode (other than periods of charging). A summary of energy and FCAS market revenue and Net Energy outcomes are shown below in Table 5.

As the net energy data shows, for the month of February, the SA BESS were mostly consuming energy in order to provide the frequency support the network required during the outage, effectively changing the operating mode of the BESS at short notice for the betterment of the system.

Table 5 - Market Revenues during SA Interconnector Outage - Feb 2020

Future Developments

The NEM will continue to be at the forefront of developments, as recently highlighted with the announcement of deployment of Virtual Synchronous Mode services at Hornsdale in coming months[2]. Combined with future developments in hybrids (both AC and DC coupled) and continuing changes in market developments, and the abundance of real-time and live data, the refinement and increased sophistication of the BESS deployments will be fascinating to both assist and observe.

Jonathon Dyson

Jonathon Dyson is Managing Director of the boutique NEM consulting firm, Greenview Strategic Consulting. Having spent the past 5 years assisting many operating and intending BESS proponents, Jonathon and his team continue to support early-stage developments, operational setup and operations deployment of BESS and hybrids in the NEM. Jonathon can be found on LinkedIn.

All of the data shown above is from AEMO, neatly managed and viewed through the data lens provided by Global Roam in the collaborative work, GenInsights21, which can be found at www.wattclarity.com.au. The author wishes to thank Global Roam for access to the data.

Banner & thumbnail credit: Picture by Petmal

- [1] The Australian National Electricity Market consists of the interconnected systems of South Australia, Victoria, Tasmania, the Australian Capital Territory, New South Wales and Queensland.

- [2] "World first:" Hornsdale battery gets approval to deliver critical inertia services to grid | RenewEconomy, Accessed August 10, 2022