Smart Grid regulatory evolution and remaining challenges in Brazil

Smart Grid technologies (SG) adds value throughout the electricity industry production chain. This value goes beyond the electricity sector, generating other types of services and additional benefits. If SG and its costs are already well known, the monetization of benefits depends largely on the impact of tariffs, the real benefits estimated, reliability and mechanisms of the wholesale market, such as energy, capacity, load balancing and energy resources integration. Thus, the work seeks to link the benefits of SG to market mechanisms under the regulatory aspects that still need to evolve in Brazil. Much still needs to be developed specially regarding tariff structures and new services remuneration models to enable SG implementation.

By José Marcelo Bandeira Filho, Eduardo Henrique Ellery Filho, Renata de Oliveira e Silva, Jose Mario Miranda Abdo, Débora Queiroz (AEA) and Cyro Vicente Boccuzzi (ECOEE)

Introduction

Brazilian Electricity Sector (BES) characteristics must be considered for structuring a sustainable SG program, mainly regarding the regional heterogeneity and diversity. Since the 1990’s Brazil has provided structural reforms on its BES seeking efficiency and economic sustainability: the segments of generation, transmission, distribution and commercialization were separated and operated by different agents.

The National Electricity Energy Agency (ANEEL) is responsible for regulating and supervising the electricity sector, in accordance with the policies and guidelines of the Brazilian federal government.

The BES is widely interconnected, constituting the National Interconnected System (SIN), which is operated by the National System Operator (ONS), which coordinates the generation dispatch of plants larger then 50 MW and also the transmission system operation, aiming to maximize the process efficiency.

There is also the Isolated System (IS), not connected to the SIN, serving about 3% of the national population, although covering more than 40% of the Brazilian territory, in the country’s Northern region.

Brazil has almost 9,000 generation plants in operation, with a total of 172 GW installed capacity, being 60,5% large hydro power, 24% thermal power plants, and 9% wind power plants. The transmission segment has more than 100 different transmission companies, with more than 140,000 kilometers of transmission lines and more than 200 strategic substations spread throughout the country.

There are 53 large Distribution utilities (DSO) responsible for ensuring the electricity supply to almost 84 million energy consumers.

Relevant aspects that impact electricity systems modernization

The BES has a broad diverse area served by different DSOs, with a large variation in load density, growth rates, electrical network topography, network expansion versus network modernization, service quality levels, etc. All these specificities make the implementation of SG a venture that requires adequate planning, taking into account the DSO’s maturity stage and its business plans in the short, medium and long-term.

This high degree of heterogeneity is one of the most challenging aspects faced by Brazilian regulators and policymakers when defining general rules to be applied to SG. There are very specific aspects that need to be addressed as priorities, making the perceived urgency to implement SG widely differentiated between each of these areas, as discussed below.

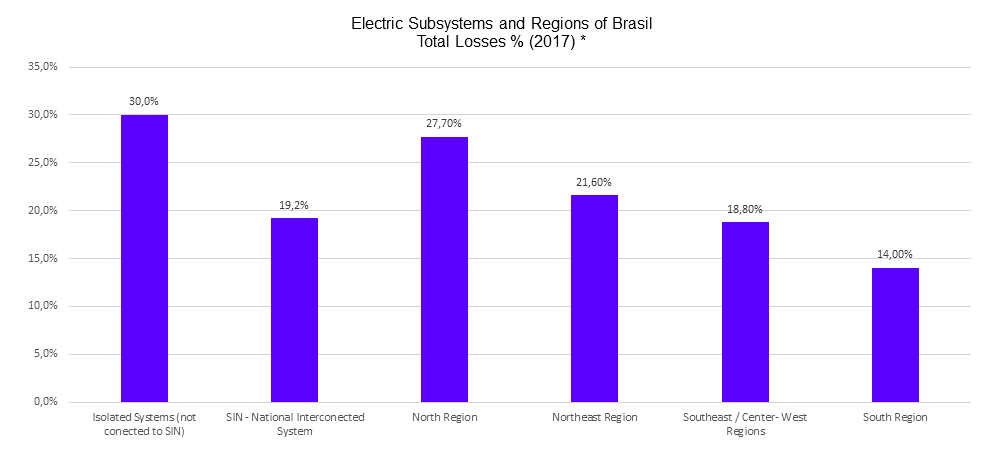

- Distribution Losses: the average losses in the country are around 19.2% and account for about 9% technical and 10.2% commercial or non-technical, related to energy theft (illegal connections or meter tampering). ANEEL sets targets for different DSOs for reductions, as losses vary widely throughout regions as shown in Figure 1.

Figure 1 - Losses of electrical subsystems Source: EPE, 2018

- Energy conservation dilemma: in the Brazilian regulatory model, market growth is the main factor that drives investment decisions and improved DSO profitability. There is a clear conflict between this model compared to qualified investments decisions in SG, which could bring energy efficiency and market reductions, not yet clearly considered in the regulation for proper compensation.

- Low voltage consumers inexistent demand charges (kW tariff) and hourly price signals: there is no hourly rate for low voltage consumers and its implementation depends on the individual costumer’s education and SG investments. All services are charged exclusively for the monthly consumption of energy in kWh and ANEEL expects that all metering investments must to be paid by DSO, without tariffs impacts.

- Tariff Pressure: Electricity tariffs in Brazil have significantly increased in recent years, due to recurrent dry seasons and the use of more expensive thermal generation, and due to the limited government's ability to deal with subsidies in specific segments such as low income and isolated system areas.

- Distribution network complexity: metropolitan areas, characterized by a higher average costumer consumption and load densities, are the most proper to the SG. In these areas, DSO would benefit from more complex tarif options, and also have lower costs for improved operation and maintenance.

- Aging network systems: assets have different level of aging, which requires a very focused and targeted urgent renewal plan, especially in metropolitan areas.

- Service reliability: some Brazilian DSO still have low levels of service quality and ANEEL has been imposing increasingly challenging targets and fines for outages duration and frequency.

The regulatory framework and the development of SG

Initial SG implementation studies in Brazil began in 2008 with the Smart Grid Latin American Forum (Forum), leading discussions and feasibility evaluation, considering the relevant local drivers and challenges. The Forum seeks to modernize electricity services in the region, in collaboration with other similar initiatives in the world.

Over nearly two decades the Federal Government had clearly excluded the focus on energy efficiency in market-oriented and policy decisions: government priority was to invest in large run off river hydro plants far from consumption centers and to complete the electricity universal access program, hugely investing in traditional line extensions ion very rural regions to serve a few sparse clients instead on distributed generation and SG.

Since 2015, when energy tariffs increased dramatically due to a series of energy policy errors combined with a severe dry period, this position began to change and energy conservation and market-related regulations started to be considered as key factors.

Even lacking a clear modernization policy, ANEEL has been working to promote regulatory developments to consider some technology-related improvements, but never consolidated a concise and comprehensive stable framework.

- The implementation of innovation is mainly done through the use of a company’s 1% of their annual net operating revenue for mandatory R&D and EE (Research and Development and Energy Efficiency) programs, as ruled by ANEEL. Companies cannot use R&D resources for regular investments, only for research.

- In 2012, a time of use (TOU) rate for the low voltage customers called white tarif was ruled, but unfortunately as optional (opt in). It is implemented for an small number of customers (less than 0.2% of customers), with reduced interest and perception of value either for DSO or costumers.

- In 2012, ANEEL established the net metering regulation over distributed generation; successfully implemented: more than 355,000 installations and 4,4 GW capacity were completed by 2020. ANEEL, however, recently opened a new discussion, after being pressured by DSOs, that claimed that the net metering was imposing revenue losses, since only during tarif revisions, which occur every five years, a new tarif level would recognize its market impact on revenues. There is currently a public debate, great repercussion, and intense dispute between solar energy stakeholders and DSOs.

- Many other SG projects have been launched or discussed, including storage, electric vehicles, etc., but this has been limited to research and very limited implementation.

- Although the regulatory agenda has not evolved in a brief and consolidated manner, many DSOs have begun to adopt various SG technologies, but not in a coordinated or orderly way. Main focus has been on:

- Metering: Telemetry for large customers and bulk metering systems to combat losses.

- Automation: substations, installation of compact medium voltage networks, with reclosers and fault sensors, and deployment of self-restoration systems.

- Cloud Information Systems: integrating functionalities of various legacy operating computer systems and analytics.

- Telecommunication systems for operational purposes, integrating various technologies and also public systems.

Most DSOs are also actively working on creating independent companies to explore new opportunities to provide services beyond the meter.

Pilot projects developed or under development

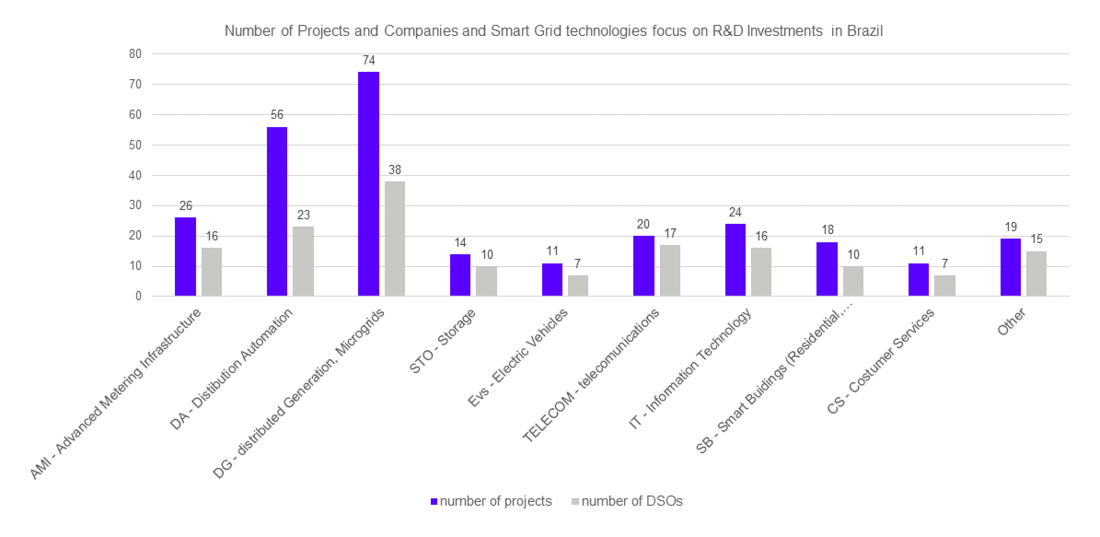

In recent years, more than 300 projects and investments estimated at R$ 1.6 billion (US$ 400 million) have been carried out by DSOs in ANEEL's official R&D programs related to SG. The 12 largest implementations are indicated in the figure and table below.

Figure 2 - Main Smart Grid Projects in Brazil and number of projects developed by area of interest

Figure 2 - Main Smart Grid Projects in Brazil and number of projects developed by area of interest

Most of these implemented projects in Brazil dealt with testing and implementation of technologies related to telecommunications, Information technology, metering integration, automation, and microgeneration. A small number covered the participation of building automation, energy efficiency, storage and electric vehicles. But no project was focused on smart rates, demand-side management, and new business models, though ANEEL is open to approving ‘sandbox’ projects.

More recently, CPFL a DSO in the in São Paulo state, completed investments in smart meters in Jaguariúna, a municipality in Campinas’s region, to have 100% of its customers served with the new equipment, for the installation of 23,000 smart meters. ELEKTRO, another DSO in the same state, completed 65,000 smart meter installations on Atibaia city and its surrounding region. More recently COPEL, a DSO serving the state of Parana, announced a one million smart meter roll-out for the period 2021-2023, and developed the first integrated planning process in its market, signing distributed generation contracts for capacity expansion purposes instead of building conventional substations.

The lack of economic signals to implement smart network infrastructure

Since 2017, the Ministry of Mines and Energy (MME) proposed significant changes in the electricity sector model, in Public Consultation 33, focusing on free market expansion, and a more active participation of the various stakeholders and consumer in the market. The discussions proceeded from 2018 through 2020, but unfortunately ended up not explanging on SG.

Currently there is a proposed law entitled PLS 232 in progress in the Federal Senate, aiming to improve the regulatory model of the electricity sector with the free-market expansion, among several other reforms and sectorial law modifications. It establishes a period of up to 42 months from the new law’s entry into force for MME and ANEEL to present a plan for implementing a completely liberalized market, and also to improve the smart metering and billing infrastructure for the implementation of other smart distribution networks technologies.

Although the development of SG is currently limited to specific technologies without a broader vision and goals, customers in Brazil are updating their technologies faster than DSOs, incorporating opportunities such as:

- Migration to the free wholesale market: the current regulations in Brazil allow consumers with installed capacity above 500 kW to access the free wholesale market. The recent increases in energy bills have driven a massive wave of customer migration since 2015; the PLS 232 promises to open the free market to all customers in the country in the coming years.

- Customers have also discovered and realized the benefits of energy efficiency and many energy-saving funded projects have encouraged the adoption of more recent technologies such as LED lighting modernization, efficient air conditioning, solar and gas self-production under net metering and/or cogeneration, building automation etc.

Even customers who are not currently eligible for the free market, such as large stores chains, banks, telecom operators, supermarkets, etc., receiving low voltage service, are already implementing energy efficiency retrofits and own generation leasing contracts with independent suppliers and energy service companies under performance contracts.

Thus, as regulations and DSO still struggle with the new technology implementations, new energy market companies and end-use customers are rushing to reduce the use and costs of implementing these new technologies.

SGs are expected to have a strong development in Brazil, mainly because of two factors: first, is the urgent need to implement effective market signals for end-users of electricity; second, is the natural pressure by customers to achieve better network performance. These two drivers, in fact, create an exceptional opportunity for Distributed Generation, which will also push pressure to implement advanced orchestration and dispatching systems by DSO.

Conclusions

The Brazilian case study presented the lack of a consolidated public policy to facilitate the technological transition DSO to SG. The adoption only of episodic and non-optimized regulations on specific themes and technologies left to the market itself the decision and the selection of investments, significantly delaying optimized and consolidated investments decisions on modernization.

On the other hand, without waiting for public initiatives in a more systemic way, the transition in Brazil is currently being led by end customers. This situation has the potential to evolve faster and faster in the more developed regions, with a rapid loss of revenue from DSO, due to increased distributed generation and other new energy efficient implementations.

A coordinated public policy for SG is fundamental for BES progress and sustainability, and must take into account:

- The continental dimensions and huge diversity of markets and distribution networks, setting specific incentives to determine how, where and when to apply SG on a case-by-case basis.

- Alignement with world best practices, consolidating a set of consistent regulatory measures to facilitate the necessary changes, which must be made by DSOs, industries and consumers. The cooperation with international multilateral groups is a must, so that international knowledge and experience can be rapidly escalated and adapted to the vast diversity amongst the Brazilian DSOs.

- Market price signals for end consumers, such as real-time energy prices and multi-party tariffs, and energy losses reduction are urgent energy efficiency priorities for more mature markets, such as those in major cities and more economically developed areas.

- The traditional DSO remuneration model should be urgently and seriously revised, as DSOs are creating new de-regulated companies. A new compensation model should encourage, in the most developed metropolitan and urban areas, priority qualified investments in advanced management and optimization technologies of the existing electrical systems, including the integration of distributed resources such as new renewable sources, distributed generation, efficient use practices, automation and end-use intelligence, rather than simply expanding installed capacity and compensation of traditional assets.

- In markets that are not yet mature, new technologies will have space primarily for microgrids and district power systems, as well as critical reliability applications (hospitals, public safety, etc.) in remote locations.

- Thus, energy policy and the resulting regulation can facilitate the creation of a new energy market, where several agents operate in a more efficient, equilateral manner and through transparent bilateral transactions, favored by the technological transition.

References

- Digitizing electricity is the only sustainable path for truly accessible energy prices to the Brazilian society as a whole – http://www.smartgrid.com.br/eventos/smartgrid2020/210.pdf

- Intelligent Electric Networks in Brazil - Cost and Benefit Analysis - ABRADEE 2012

- Intelligent Electric Networks in Brazil - Subsidies for a National Deployment Plan - ABRADEE, 2012

- EPE – www.epe.gov.br

- ANEEL - www.aneel.gov.br

- PLS 232 - Federal Senate

Illustration credit: Banner & thumbnail by Sergio Souza on Unsplash - Guarujá (Brazil)