Ready or not, here comes an Open Ecosystem for Wireless Broadband

The cellular ecosystem is quickly evolving, thanks to the continuous search for improved system performance and the next worldwide generation of wireless technology. Other factors driving this evolution in part include new federal policy and advances in open radio access network technology. It is rarely one disruption that pushes an industry forward and this is not unique in that regard.

Open radio access network (RAN), or O-RAN technology, is emerging as an attractive cellular solution that is starting to be embraced by both government and industry. The exact benefits are still disputed by some, but there is also evidence that these new concepts are starting to be embraced more broadly.

By Jeff Casey and Bruce Albright, Burns & McDonnell

In mid-November 2020, the U.S. House of Representatives unanimously passed a bill that will direct $750 million in proceeds from recent spectrum auctions toward the domestic 5G equipment market in an effort to boost development of open standards-based 5G hardware and software. The bill’s most prominent goal: strengthening the competitiveness of North American supply chains for communications equipment deployed on 5G networks.

Carrier Industry Driving O-RAN Adoption

Cellular system advancement starts with the carriers and it should be noted that major telecom carriers in the U.S. are cautiously exploring O-RAN in their networks.

DISH is moving quickly to become the fourth U.S. national cellular carrier and is aligning those efforts with a commitment to O-RAN for its 5G rollout. In December 2020, DISH announced it is bringing together a truly multivendor solution with different partners for core, software and radio units (RUs).

International carriers Vodafone and Telefonica also have large-scale pilots underway in certain markets and have noted the positive performance and benefits of O-RAN. These carriers were among the first to take open access systems out of the labs and into field trials.

From Closed to Open Systems

It is well known in the industry that the Evolved Packet Core (core) and RAN ecosystem have become very concentrated. A small group of large companies hold immense market power. These oligopolies dominate, control price and prevent others from significantly influencing industry direction. Until recently, RAN systems have effectively been closed because hardware and software have been intrinsically linked.

Traditional RAN systems are supposed to interoperate with any RAN component, as long as core and RAN conform with 3rd Generation Partnership Project (3GPP) standards. However, in practice, this has not been the case. Although they may meet the standards for interoperability, the interfaces and software have largely remained closed or are proprietary. This has in essence created a single vendor platform per deployment or region. The end result for users is that traditional RAN deployments are locked into the same vendor for both radio and baseband units.

Building a more cost-effective, versatile and agile RAN requires openness. Open interfaces can enable multivendor deployments, enabling a more competitive and diverse supplier ecosystem and prevent vendor lock in. Similarly, opensource software and hardware reference designs enable faster, more democratic, and permissionless innovation.

What is Open RAN?

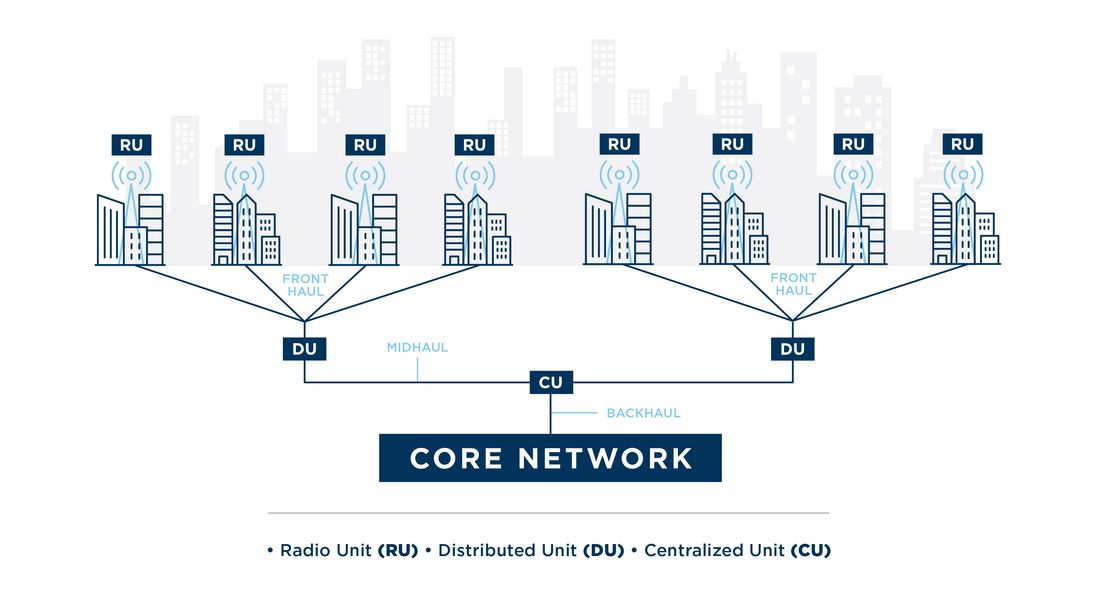

O-RAN systems promise to turn this closed system on its head by maintaining adherence to 3GPP standards but breaking the links between hardware components and software code. This is done by designing and building open ecosystems of hardware and software from multiple original equipment manufacturers (OEMs).

All are designed to work seamlessly through open interfaces. More specifically, O-RAN opens the interface between the base band unit (BBU) and the remote radio head (RRH) so that any supplier’s hardware works with any supplier’s software. In an O-RAN environment, the BBU is virtualized on commercial off-the-shelf (COTS) servers and the RRH hardware is vendor agnostic.

The interface between this equipment has historically used vendor-specific implementations of the common public radio interface (CPRI) protocol. The industry seems to coalesce around opening up this interface as the first step in O-RAN. It becomes less clear how the architecture gets functionally split.

The O-RAN Alliance has articulated goals for creating O-RAN standards that enable a more competitive and vibrant RAN supplier ecosystem. The endgame will be an industry that innovates faster and, according to the alliance, includes “O-RAN-compliant mobile networks that improve the efficiency of RAN deployments and operations.”

System Complexity

The complexity of today’s RAN systems should not be underestimated. Though cellular RAN systems are widely available through any of the current manufacturers, it still is a tall order to bring all the disparate parts together and architect them to perform as desired.

In theory, buying a traditional core and RAN from a single OEM and making them work together creates fewer deployment issues because they are engineered to work together. However, only those components from the same vendor are designed to work seamlessly and maximize end-to-end system performance.

Disaggregating the RAN through multiple vendors and expecting it to perform the same as if all components were from the same vendor has not been easy to do and, historically, has even been discouraged.

O-RAN imagines a world where we can mix and match hardware vendors and software providers. These traditional challenges don’t just go away with O-RAN, either. In addition to the normal RAN complexity found in a closed solution, it will also create new challenges like the need for a deeper understanding of virtualized hardware and software platforms by industry and systems integrators. These skills exist in the world, but remain immature in the industry.

Disaggregating the RAN on its own is challenging. Integrating multivendor solutions and having them perform the same as a single-vendor solution is the next frontier. Time will tell if the benefits of the open ecosystem outweigh the cost, or if we are just trading one complexity for another.

Competition and Supply Chain Diversity

Barriers for market entry are being lowered as the movement toward an open ecosystem relieves the high fixed costs of starting up manufacturing operations. This potentially could bring in a range of new small, medium and large players into the cellular ecosystem and bring benefits to the utility sector. Utilities should see fast progress due to competition between traditional hardware manufacturers and new software companies.

As the industry moves toward open hardware and software, utilities will benefit as the supply chains become more resilient and diverse. Buyers can avoid being locked in with one or a small group of vendors as multiple OEMs achieve the capability to roll out utility-centric feature sets and systems that are needed.

The goal of true plug-and-play RAN hardware will be realized as baseband units, radio units and remote radio heads can come from an increasing pool of vendors. The hardware may be important, but the real key is how the software is overlaid to deliver system performance. Systems managed by O-RAN software will form a truly interoperable and open network.

As the underlying hardware — primarily radios and servers — stay on-site, the software needed to add features and upgrade performance is the only remaining element that would need to be changed.

Total Cost of Ownership

Though the full benefits of O-RAN are still being proven out by early adopters, we can begin to envision how and where the total cost of ownership will become more advantageous over time.

RAN is a large component of capital expense and upon deployment becomes a significant element of ongoing operations expense as well. RAN can often account for up to 80% of the overall expense, due to the geographic scale and size of the network.

The potential of O-RAN to reduce both capital and operational expenses by double-digit percentages over traditional RAN deployments seems possible. Cost benefits may be derived from these areas:

- Increased supplier competition in the market driving equipment costs lower.

- Network deployment and operational improvements from virtualization and disaggregation;

- Flexible, extensible and scalable hardware and software implementations to better meet system requirements.

Utilities are understandably sensitive to costs of telecom deployments. O-RAN shows potential for cost savings, both on the front end of projects and over the long haul of operations. It has to stand on its own both technically and commercially.

Ecosystem Flexibility

The day is approaching when it will no longer make sense to buy single-purpose boxes that do not play well with devices designed by other OEMs.

In today’s world of heightened cyberthreats, an inflexible ecosystem aligned with a single vendor opens up a platform that is subject to risk from attacks. Should a vulnerability be found within a firmware or software version that has been broadly deployed across the network, greater overall systemic risk is the result. There is no perfect cybersecurity solution and O-RAN has its own subset of security challenges that come from being an open architecture. The question becomes: Can it provide security equivalent to that of a closed platform? Or, better yet: When do the benefits surpass the ability to mitigate the risks? Surely some openness is better than none, but there is a valid argument that some key closed parts are better left closed. This is one of the key challenges the industry must resolve.

A multivendor solution provides the flexibility to choose best-in-class components for deployments. Software can be tailored to meet the performance requirements of any utility, all working on proven hardware platforms. System requirements and use cases could be matched, enabling utilities to customize systems for their own operating environments and demands. For example, splitting the architecture and disaggregating the RAN opens the opportunity for an improved feature set and better localized optimization. It enables adaption to specific use case requirements that may have variable latency or throughput. Utility-grade LTE built on carrier-grade technology could be a win-win model for utilities.

Luckily for utilities, having a greenfield network build-out ahead of them means they can skip the transitionary steps and legacy support required for operators with existing previous generation networks. They have the opportunity to architect the network they need, when they need it.

Getting to O-RAN Utopia

Will O-RAN be ready for utilities? Yes. The path to get there seems imminent.

The real question is: Will utilities be ready for O-RAN?

There is no question it is ready for the second-generation (fast followers) in the wireless broadband space. Utilities, however, may be a bit less likely to be in this group. They have been institutionally cautious, and this is understandable, as there is still plenty to learn. It’s easy to surmise that they won’t want to move at the pace of the carriers, but rather shortly after them.

Utilities that are now evaluating and planning for private LTE systems should be thinking about the benefits that O-RAN could bring as part of these deployments. Many may conclude it is a step too far today. But what about two or three years in the future?

O-RAN is not the end-all, be-all to solve every unique operating challenge facing utilities. It must be evaluated against the full range of use cases and criteria unique to every utility. This should be no different from evaluations that look at 4G LTE/5G components, including technology, vendors and spectrum options.

Ultimately, however, the benefits of greater competition and innovation may outweigh the value gained from a single-vendor approach. With all the new spectrum and technology options emerging for utilities, the era of private wireless broadband networks is coming at the right time.

Illustration credit : Banner and thumbnail by metamorworks on iStock