A season of high electricity prices in Europe

The fall and winter 2022 have been remarkable in terms of electricity prices in Europe. In an area with 450 million inhabitants and an annual electricity consumption of 2,000 TWh, wholesale electricity prices during late 2021 and early 2022 were, on average, 3 to 5 times higher than they had ever been in the past. For many Europeans, including retail customers facing sudden rate increases by the end of the year, this period of high prices came as a surprise. However, the conditions for this development had been slowly building up over the previous six to twelve months.

This article highlights the singular nature of these events and discusses the main causes of these developments. The analysis is limited to the period until January 31st, 2022, i.e. without considering further price shocks caused by the Russian intervention in Ukraine in February 2022.

by Vincent Ringeissen, Christian Hewicker & Yannick Phulpin

A particular situation

European power markets in short

In the European market design, wholesale electricity markets are based on the concept of zonal pricing. Depending on the structure of the network, national energy policies and historical organizations, most European countries rely on a single bidding zone, e.g. Spain, France or Poland. Multiple bidding zones exist in a few countries country, like Norway, Sweden or Italy. Within each bidding zone, market prices are set by the marginal price of available offers, incl. those imported from other bidding zones through cross-zonal exchanges.

In line with its overall objectives of creating an internal electricity market, the EU has been promoting cross-border trading and regional integration for more than two decades. Today, the wholesale markets of all 27 EU countries (plus Norway) have been integrated by means of Single Day-ahead Coupling (SDAC). Similarly, intra-day, ancillary services and real-time balancing markets had been coupled already, or were in the process of being coupled. As a result, electricity prices align when the cross-zonal capacities suffice to manage efficient exchanges, and cross-zonal exchanges are scheduled consistently with price signals.

Figure 1 - Geographical scope of market coupling in Europe

(Source: https://www.nemo-committee.eu/sdac)

Analysis of spot prices

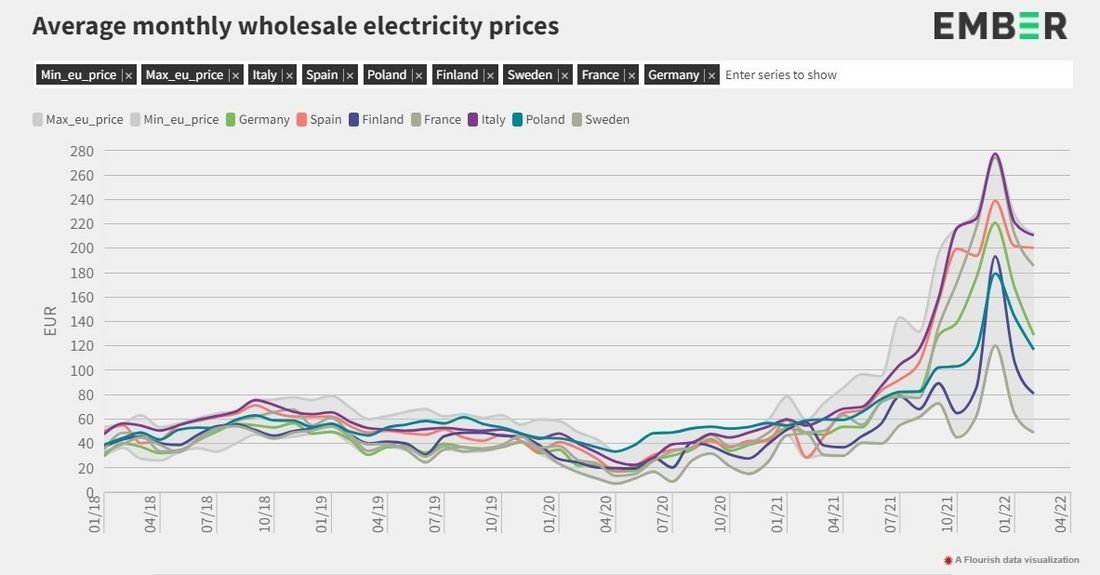

While some bidding zones in Europe had already experienced periods with high prices, mainly during events related to exceptional weather conditions, the last fall and winter have been exceptional as highlighted in Figure 2.

Figure 2 - Monthly average day-ahead prices in several European countries from 2018 through 2022

(Source EMBER - https://ember-climate.org/data/data-tools/europe-power-prices/)

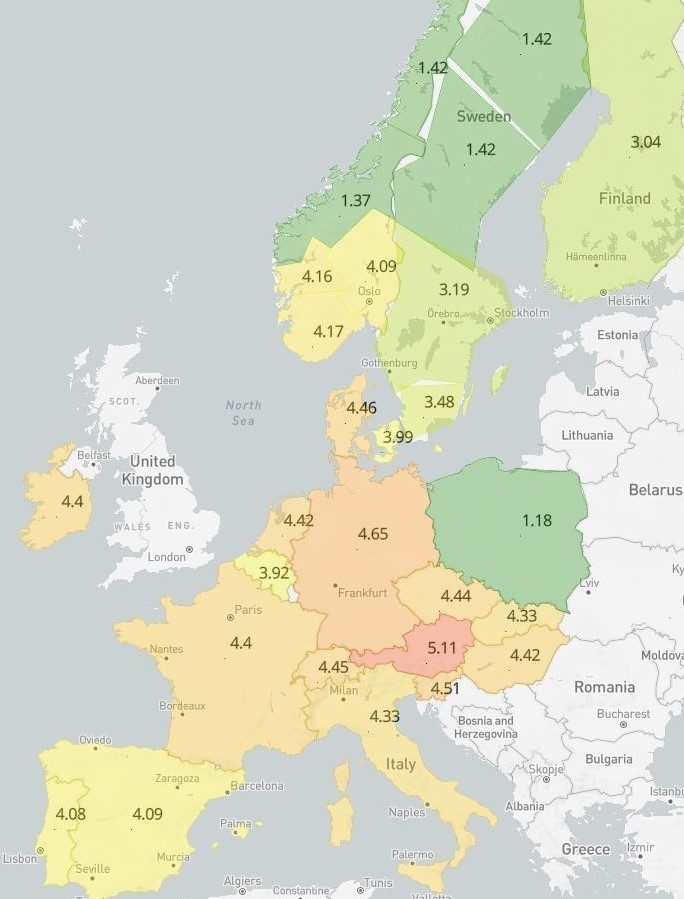

Figure 3 displays two main characteristics of the last season:

- Level of spot prices: in most bidding zones, wholesale prices were several times higher than they had been during the same quarters of the last 6 years. For example, the average of German spot prices over the last quarter (Q4) of 2015-2020 was 38.5 €/MWh, against 178.9 €/MWh in Q4 2021.

- Geographical extent: unlike past high-price events, the phenomenon affected an exceptionally large area. Extreme prices were observed across most of Europe.

The bidding zones where spot prices remained in the same range has the previous years (for example 44.5 €/MWh in Sweden 2 Vs 31.4 €/MWh in Q4 2015-2020), are located in a region between Norway and Sweden with massive hydro resources and limited export capacity. Prices did not reach unprecedented levels in Poland as well. This is related with regional specificities in terms of fuel supply and with the relatively low cross-zonal exchange capacities, which leads to different price dynamics than in the neighboring countries.

Figure 3 - Ratio between i) the average spot prices over the last quarter of 2021 and ii) the average spot prices over the last quarters of 2015-2020 (Source: Authors’ analysis, data based on ENTSOE Transparency)

Gradual tightening of European wholesale markets

As already visible from Figure 2, wholesale electricity market prices had gradually increased throughout 2021. Daily base load prices in Germany, the largest European power market, regularly exceeded 150 EUR/MWh since early October already. A closer look at market fundamentals shows that this trend was driven by several developments, which ultimately prepared the ground for the unprecedented price levels in late 2021.

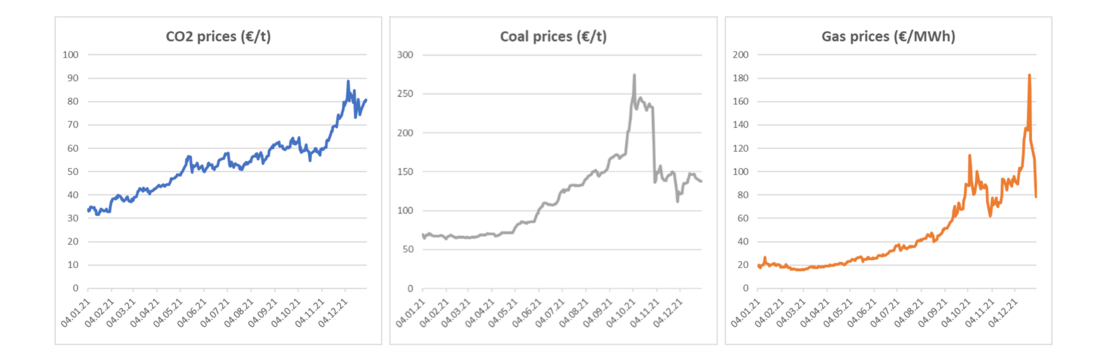

Overall, the year 2021 was characterized by strongly increasing commodity prices (see Figure 4):

- Driven by the European Commission’s ‘Fit-for-55’ proposal finally published in June 2021, foreseeing a further tightening of the EU’s GHG emission reduction target for the year 2030, European carbon prices experienced an almost three-fold increase from less than 30 EUR/t in Q4/2020 to more than 60 EUR/t by early October and about 80 EUR/t by early December 2021.

- Due to very strong global demand especially from Asia, coal prices tripled from less than 60 EUR/t in Q1/2021 to 180 EUR/t by Oct 2021, before consolidating in a range of 120 - 150 EUR/t thereafter.

- Finally, European gas prices increased four-fold from about 20 EUR/MWh in Q1/2021 to more than 80 EUR/MWh since early October.

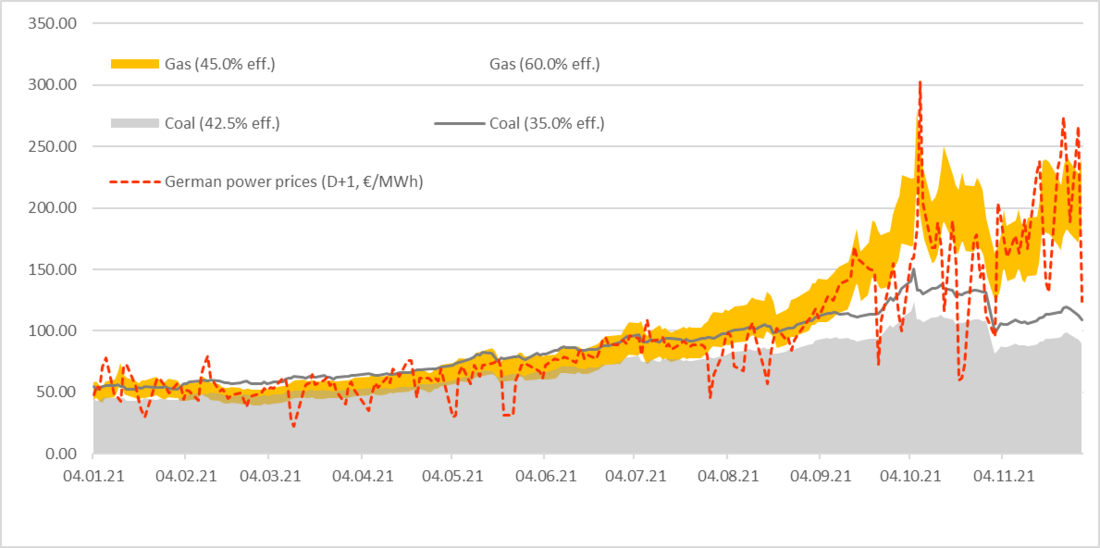

Rising coal and carbon prices should, in principle, favor the use of natural gas for electricity production. This effect was indeed visible in the first few months of the year when gas became increasingly competitive compared to coal. Consequently, electricity generation from natural gas across Europe returned to levels experienced before the Covid-19 pandemics. Conversely, consumption of hard coal and lignite remained about 15% lower than in 2019, arguably dampening the increase of carbon prices.

Figure 4 - Strongly increasing fuel and carbon prices during 2021

(Source: Authors’ analysis, data courtesy of EEX)

Yet, the situation changed fundamentally during the summer. Natural gas prices started to grow at an even faster pace than coal prices (compare 4), again in part driven by much higher-than-expected demand in Asia and the re-routing of LNG deliveries originally destined for Europe to Asia. During the fall, this trend was further reinforced by an increasing tightening of European gas markets. Especially during the first half of 2021, European gas consumption grew significantly and returned to similar levels as in 2018, in part due to economic recovery from the pandemic situation and in part due to a prolonged winter. Simultaneously, European gas production continued to decline, whilst LNG imports between January and November were about 13 – 15% lower than in the previous two years.

Figure 5 - Costs of electricity from gas and coal vs. wholesale electricity prices (€/MWh, Jan – Nov 2021)

(Source: Authors’ analysis, data courtesy of EEX)

Although these developments were partially compensated by additional pipeline imports from North Africa, Azerbaijan and Norway, the remainder had to be offset by withdrawals from European gas storage. By the end of June, this had resulted in European gas storage stocks reaching their lowest level over five years (Figure 6). After the summer, it turned out that Gazprom, which alone accounts for roughly 50% of total European pipeline imports, was supplying substantially less natural gas to Europe. Compared to the first half of the year, total European imports from Russia [1] declined by about 10% in August/September and 15% from October onwards. As a result, European gas stocks further deteriorated, reaching historic lows by the start of the heating season. During the last quarter of the year, this led to increasing concerns about potential gas supply shortages, especially in case of a cold winter.

By the end of November 2021, European electricity market had thus entered into a very tight situation with unprecedented price levels for energy commodities and electricity across most of Europe. Electricity generation costs from coal and natural gas had drastically increased by about 100% and 250%, respectively, between January and November. Moreover, with coal/lignite and nuclear power running at high capacity factors already, natural gas had clearly become the marginal fuel. Consequently, any incremental generation had to be primarily supplied from European gas storage. Yet storage inventories were at historically low levels and had become the source of concerns on possible gas supply risks.

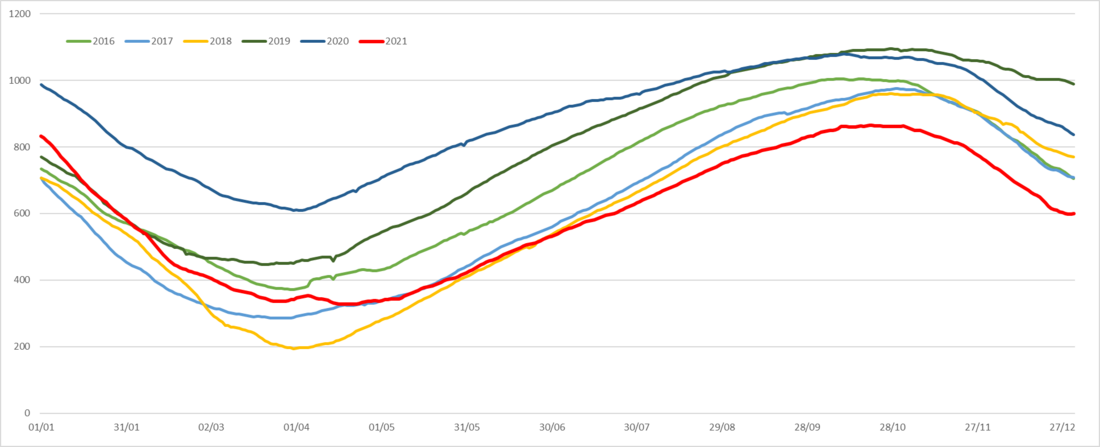

Figure 6 - EU gas stocks by year (EU+UK, 2016 – 2021, TWh)

(Source: Authors’ analysis, based on Gas Infrastructure Europe - https://agsi.gie.eu/#/historical)

Vulnerability of tight wholesale markets

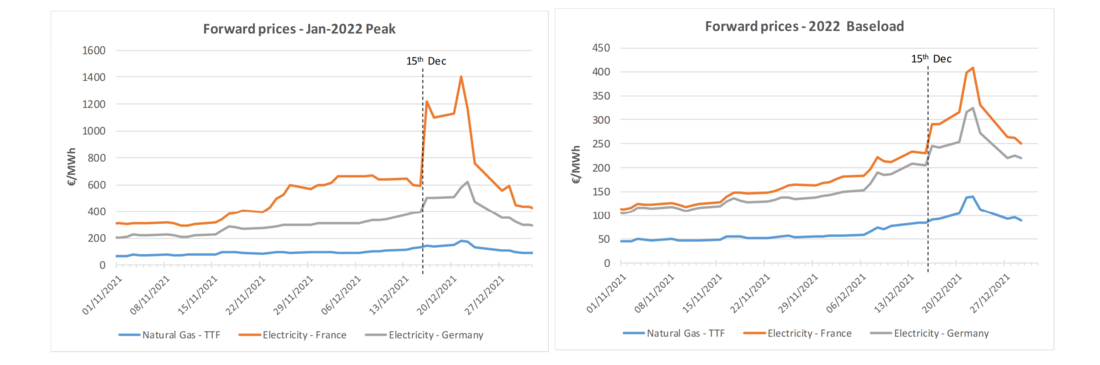

In the environment of record-high and rising prices across Europe described before, concerns on electricity supply during Winter 2021- 2022 grew significantly with the announcement of a lower availability of nuclear reactors in France. On December 15th, the markets were informed that 3.6 GW of baseload generation would be unavailable at least until January 2022. The market reacted with a sharp increase in forward prices (see Figure 7), with peak deliveries for January 2022 quoted at around 1,200 €/MWh in France and around 500 €/MWh in Germany. In the meantime, gas price “only” increased by 10€/MWh.

Over the next week, prices continued to steadily rise in line with gas prices. Then, mild weather and above-average temperature forecasts across Southern and Western Europe and news that more LNG supply was coming back from Asia helped to decrease concerns for gas and electricity alike. Forward prices for delivery of gas in 2022 peaked at 140€/MWh on 22nd Dec before dropping to below 90€/MWh on 29th December. Simultaneously, electricity forward prices for France decreased from 410 €/MWh to 250 €/MWh.

These events highlighted that high commodity prices and low levels of gas storage leverage the impact of changes in electricity demand and baseload generation forecasts on electricity prices.

Figure 7 - Forward prices for delivery Jan-2022 Peak (left) and 2022 Baseload (right) from 1st Nov 2021 till the end of the year (Source: Authors’ analysis, data courtesy of EEX)

Summary and outlook

Between mid-2021 and January 2022, wholesale electricity prices across Europe reached unprecedented levels and volatility. This was caused by a number of factors, incl. a strong increase of European CO2 as well as global coal and gas prices. In the fall, this trend was further fueled by record-low gas storage levels in Europe and concerns on possible supply shortages. Against this background, the unexpected unavailabily of nuclear power triggered extreme price spikes for both electricity and gas, before re-routing of LNG and promising weather forecasts eased the situation.

Overall, these experiences highlight both the success of EU energy policy in creating a common electricity and, more widely, energy market and how a fully liberalized market can lead to volatility and price risks for electricity supply. Yet, European electricity markets have not only proven that they do respond to changing conditions, but they have also been robust enough to deal with the supply shocks experienced in December 2021 and – only a few weeks later – the even larger uncertainties created by the war in Ukraine since mid-February 2022. And whilst it appears that substantially increased electricity prices are likely to stay for the foreseeable future, market participants have consistently been able to trade several years into the future at prices well below the extremes experienced in the short-term markets, even during the most critical periods.

The authors would like to express their gratitude to Julien Demoustier (EEX), Cyril Gisbert and Christian Nallatamby (EDF R&D) for their support in the drafting of the paper

Thumbnail & banner credit: Photo by Nicholas Cappello on Unsplash

- [1] Excluding imports to South-Eastern Europe via Turkey.