New CIGRE Green Book: Power System Assets: Investment, Management, Methods and Practices

By the Editorial Team: Graeme Ancell, Gary Ford (Lead), Earl Hill, Jody Levine, Christopher Reali, Eric Rijks, Gérald Sanchis

The title of this Green Book aligns with the primary focus of the book while recognizing the developmental status of asset management. For over two decades asset management has been a primary focus of Study Committee C1. As well several other Study Committees have made significant contributions in asset management for applications related to their specific technical focus. Organizational processes to implement asset centric management functions have been effectively dealt with in the recent ISO 55000 series and in its predecessor, PAS 55. However, there is scant published information describing the details of the technical, financial, risk-based methods used in practice by utilities to support investment decisions. This book focuses on that specific aspect by providing up-to-date information on the methods and practices available for the asset management function and how they are used to justify asset investments. A working title, “Asset Management Methods – a Work in Progress” was crafted by the editorial team to recognize that asset management methods have not yet developed to a mature technology stage. Unlike Green Books on technologies that have developed over many decades into very mature states, asset management methods continue in a relatively early stage of development, as they respond to changing business and regulatory environments and demands. Therefore, the objective for this CIGRE Green Book is to describe the state-of-the-practice of asset management methods as of 2022; but also to be a comprehensive living e-document that describes improvements as they develop in the years ahead. The book includes information developed in CIGRE as well as key information related to asset management methods published by other technical organizations, government organizations and utilities over the past two decades. It also includes new technical and financial analysis methods adapted for asset management needs from other purposes. This CIGRE Green Book will be of value in all areas of utility asset management investment planning. The book is designed to have a handbook character and to be a practical guide written at a tutorial level suitable for working asset mangers and decision-makers (both engineering and financial) dealing with the practice of asset management.

The major focus of this book is on documenting practical methods for bridging the so called “line of sight” or the gap between just satisfying an asset management process and achieving real asset management results in the form of smarter investment decisions. Consistent with the scope of Study Committee C1, this book facilitates collaboration and blending of the engineering and technical aspects of asset management and the financial considerations needed to support asset investment decisions using risk-based business case analysis.

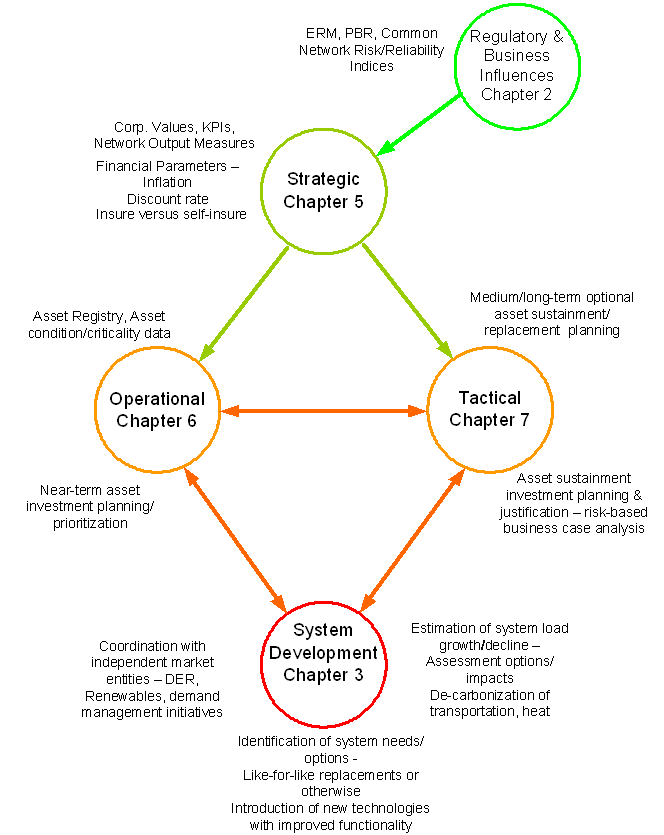

The book is arranged in two parts. Part 1 describes the evolution of asset management business concept, the business and regulatory drivers that have, and continue to, influence it and the functional framework for asset management as developed in previous CIGRE technical brochures. The basic framework for Part 1 is illustrated in figure 1.

Figure 1 - The asset management functions and their relationships. A chapter is dedicated to each of the three asset sustainment functions as well the system development function. The book also devotes a chapter on the influences of governments and regulators on asset management, a chapter on asset aging processes and a chapter on risk-based business case development for assessment of optional tactics and investments

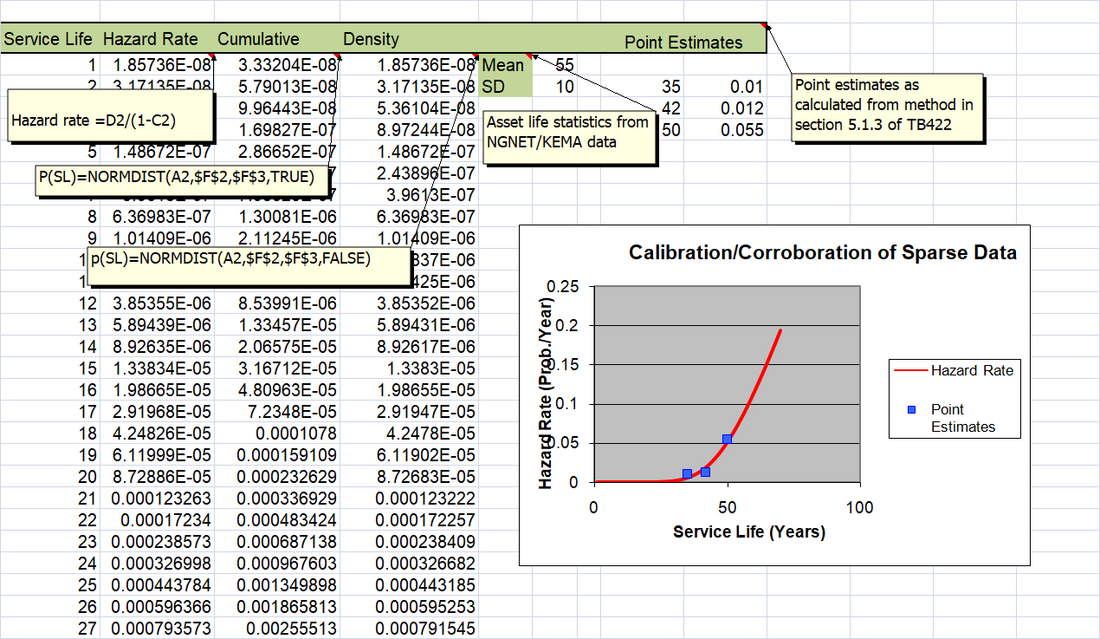

Documentation of the theory of technical/financial/risk-based methods used in asset management decision-making is a necessary prerequisite; but it is often even more instructive to see how these methods are applied in practice in the form of examples and detailed case studies. Part 2 of the book includes 12 case studies provided by utilities, an insurance company and the editors which demonstrate in considerable detail how these methods are applied in practice. The case studies illustrate generic and specific or customized methods and the application of such methods from the technology perspectives of several CIGRE Study Committees including, for example A1, A2, A3, B1, B2, B3, C2, and C4. The case studies include wherever possible, sufficient information so that users of the Green Book can easily understand the details and apply them to their own company’s needs. Flow charts for calculation processes and annotated spread sheets are included in both Parts 1 and Part 2 such as illustrated in figure 2.

Figure 2 - A typical illustration from the Green Book of an annotated spread sheet showing the underlying calculation formulae for fitting sparse failure data to an industry based hazard rate function

The Green Book also addresses important gaps and issues not well understood or documented in the literature or public domain sources. The first of these is the recognition in risk-based business case analysis, that methods for valuing monetized risk in business cases are not well established. This problem has been recognized in the UK and elsewhere, but no methods have been published. Chapter 8 in Part 1 of the Green Book which is devoted to business case analysis proposes an actuarial method to assess and value risk costs that can be compared with optional Capex/Opex investment costs over a planning period to develop a rigorous risk-based justification for asset management investments.

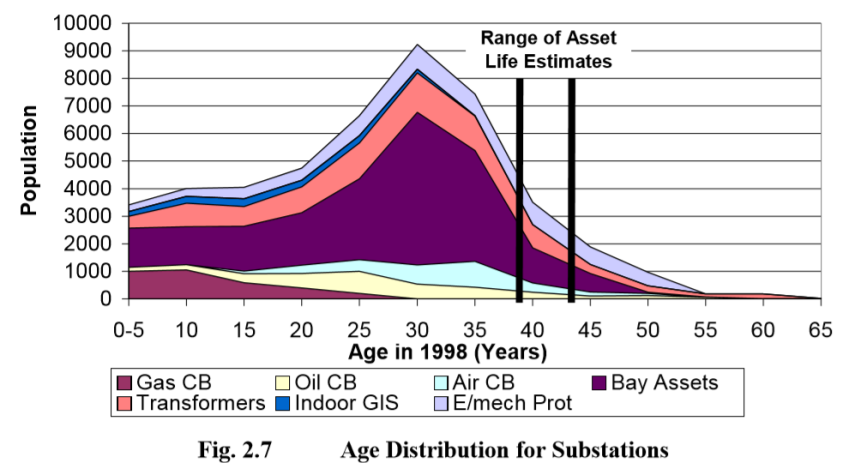

A second undeveloped area is the “Bow Wave” and methods for managing its adverse asset population demographic. The Bow Wave was coined by CIGRE WG 37.27 over two decades ago when utilities recognized that the demographic distributions of populations of key assets displayed a distinctive peaked profile as illustrated in figure 3.

Figure 3 - The typical Bow Wave, asset population demographic pattern confronting asset managers [TB 176, 2000]

The bow wave was caused by the economic and industrial expansions that occurred post 1945, which required the procurement of very significant numbers of transformers, circuit breakers and other assets to meet rapidly growing system demand. By the end of the 20th century, load growth had levelled out and many of these assets were approaching the 40-50 year age range which is typically considered to be near end-of-life. The Bow Wave problem anticipated that over time the number of asset failures, or assets deemed by experts to be at end-of-life would increase and that this would create problems for both utilities and equipment manufacturers. As well it was anticipated that regulators would be concerned about significant increases in capital costs and would require utilities to develop asset management plans to mitigate rate impacts. Unfortunately, methods to estimate the numbers of asset failures (and prudent proactive replacements) going forward over a prospective 10 or 15 year planning period have not been well documented. The Green Book in Part 2 includes a case study that highlights two approaches that are in the public domain. This case study describes in detail one of these approaches and provides detailed information on its application.

In the light of climate change initiatives such as Net Zero 2050 and needs for increased systems resiliency, utilities expect significant system development challenges and regulatory changes. Many jurisdictions continue with traditional regulatory methods. However, utilities may expect regulators to gradually move towards more effective use of performance based regulation based on consumer oriented monetized measures such as energy not supplied (ENS) or value of lost load (VOLL), customer satisfaction measures and environmental and safety measures. Increasing scrutiny by regulators and interveners can be expected on justification of sustaining investments including requirements to have considered several non-conventional options such as investments in demand management, distributed generation and so on, as alternatives to like-for-like asset replacements.

Utilities and other electricity market players (TSOs, DSOs, DER developers and other market entities) can be expected to become increasingly interested in coordinating and sharing the risks and benefits of infrastructure investments. This will also drive a need to further develop methods and processes to coordinate and prioritize system development and asset sustainment investments under the constraints of regulatory and performance measures, resources, finances and supply chains. This will also drive a need for better and faster risk-based business case analysis to quantify the technical/financial/risk specifics of such collaborations. While the methods documented in this book describe the current state of the practice and emerging methods, they also point to the need for utilities, businesses and academics to develop better methods to value and manage risk and to facilitate smarter and more profitable business investment decisions.

The Green Book is available for purchase on our partner's website Springer.

If you are an CIGRE Member, please contact us to benefit from a 40% discount on your purchase (please indicate your active member number and your National Committee in your message).