Hydrogen developments and opportunities in the MENA region

The expectation is justified that the potentially ‘net zero emission’ energy carriers, electricity (‘electrons’) and hydrogen, including E-fuels (‘molecules’), will be gradually taking over the dominant role of fossil carriers on the route to global energy supply without remaining greenhouse gases.

By Paul van Son, President and Chiara Aruffo, Director of Research, Dii Desert Energy, Munich/Paris/Dubai

Electricity and Hydrogen, from both renewable or nuclear origin, or from fossils and carbon capturing, shall thus be able to serve global demand by 2050 to reach net-zero targets [1]. Of these ‘net zero emission’ sources, renewables seem to have the best cards due to the abundant natural energy on Earth at ultra-low-cost levels. Renewables deserve an extra premium through the value of Guarantees of Origin produced. Nuclear and fossils, paired with CCUS (carbon capturing and reuse), may still play a role, provided they will match the strong competitiveness of local and global renewables. ‘Net zero targets’ imply that the cost rep. penalties of carbon emissions shall dramatically increase and, eventually, greenhouse gases shall be prohibited entirely (like ‘no smoking’ in restaurants). A pivotal role for fluctuating renewables implies a larger need of flexibility in the energy chains at the production, power to hydrogen conversion, transport, storage and demand side.

In this context the energy markets will dictate a shift from fossil energy carriers (about 80%) and electricity (about 20-25%) to date toward a new balance of electricity, hydrogen / E-Fuels and fossil plus CCUS to serving industry, transport, commercial and residential sectors.

The MENA region with its over 14 mln Km² desert areas and abundant solar and wind energy is best positioned to, not only speeding up its own economically viable energy transition, but also to becoming a ‘green powerhouse’, serving the global energy markets, not the least Europe [2]. The region is currently experiencing a strong renewables and hydrogen momentum, which is reflected in numerous new solar and wind projects and an avalanche of hydrogen project announcements. From what we have learned with solar and wind project announcements in the last decade, of course, not all announcements must be taken too seriously, but rather as a precursor of a serious trend. There is reason to believe that the present steep growth of exceptionally cheap renewables in the region will be followed by a similar surge of electrolyser capacity to produce hydrogen. The availability of low-cost land, ongoing ‘petro-dollar’ revenues and existing hydrocarbon expertise and infrastructure, is another competitive advantage of several MENA countries. In the last decade the early leadership of Morocco and the UAE have ignited the energy transition in - among others - Saudi Arabia, Oman, Egypt, Israel and Jordan. The transition itself will not be without major challenges, facing the usual obstacles in these desert areas, such as inclusion of the local population, water-scarcity, opposition by vested interests, the need of coherent infrastructure planning and off-take arrangements, offering stability and attracting investors, and, last but not least, keeping expectations realistic.

Production of hydrogen and its derivatives shall in the first place serve local demand, thus, establishing low emission economies across MENA. Additionally, the MENA region could position itself as a significant green Powerhouse. It could be serving the EU and other countries that lack sufficient solar, wind and hydro resources for both serving their electricity demand and on top to satisfy emerging hydrogen off-takers. Hence notorious energy import countries will continue to import energy, but instead of sticking to fossil carriers they will shift to importing hydrogen and E-fuels. Therefore, only countries that timely develop and implement a clear future-oriented strategy to bolster zero and/or low emission hydrogen production will capture the benefits of this emerging trend. This includes substituting local fossil energy demand with green, low emission products and establishing export channels. Existing and new infrastructure and interconnections will play a crucial role. They need to be carefully designed and planned, leveraging also existing infrastructure, for example blending hydrogen in gas pipelines or turning the gas system into a hydrogen system.

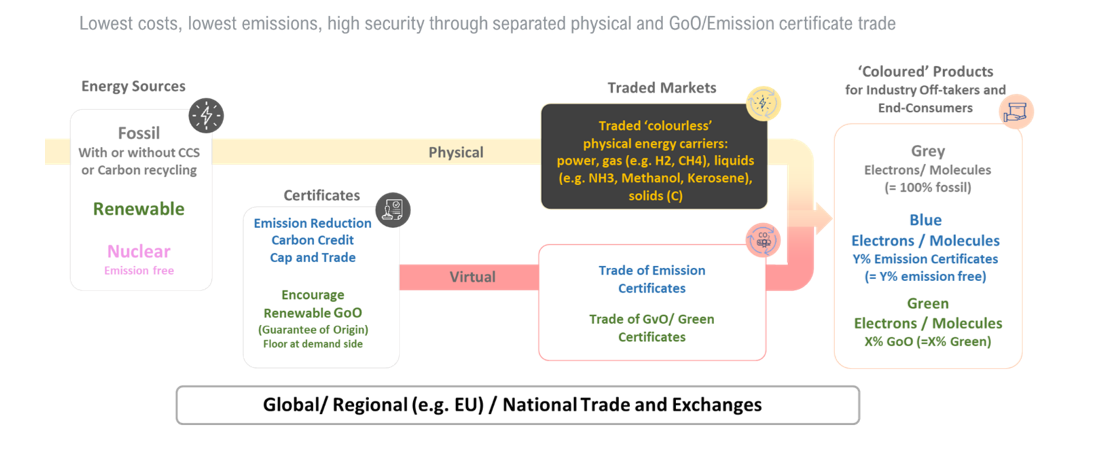

In the past months, several MENA countries have announced bold initiatives and targets, such as Oman [3] and UAE [4] at the end of 2022. These are the first stepping stones towards the establishment of national and cross-national hydrogen strategies and economies. The emergence of a global green or low emission hydrogen market will require a strengthened international cooperation and standardization. One of the most important prerequisites for a traded market of lowest cost, high security of supply and zero emissions is an effective separation of trading physical energy carriers (electrons and molecules) - which cannot ‘tell’ what their origin is - from the information about their origin and net emission (based on reliable certificates: Guarantee of Origin/Renewable and/or Emission Credits). Physical energy carriers would obtain their price through supply and demand matching, while Green and Emission certificates through supply and demand within caps and floors. Certificates allow among others the demand side to become an accelerator of green / emission free supply. However, legislation for traded certificates with caps and floors is not yet universally introduced globally. At present the so called ‘Delegated Act’ (RED II) of the EU seems rather to be a step backward than ahead. To enable initial projects first partnerships and (potential) off-take arrangements with MENA countries are underway on a case by case basis. Multilateral agreements have been signed with, among others, Germany, Belgium, UK and the Netherlands.

Hydrogen status in the MENA region

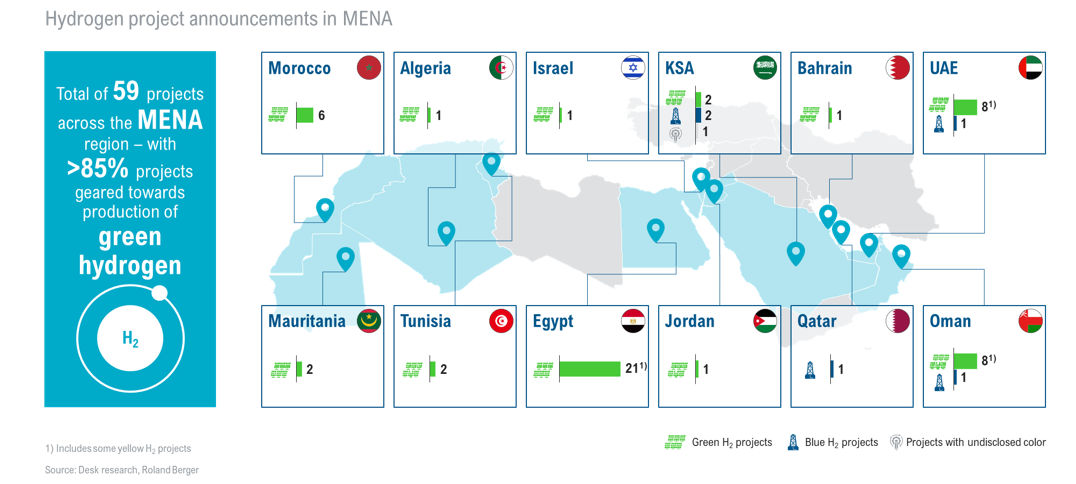

The first announcements of hydrogen projects in the MENA region date back to 2020, marking a turning point for the energy landscape. The pace of announcements has continued to ramp up in 2021 and 2022 with 59 (!) announced projects as of January 2023. More than 85% of these projects are for producing green hydrogen i.e. using renewable energy as a source. Less than 15% is ‘blue’, i.e. fossil based including CCSU (Carbon Capture Storage and Re-Use).

Egypt is presently the leading country in terms of announced projects (21), following a series of MoUs signed in the occasion of COP27 hosted in 2022 in Sharm El Sheik. It is important to remark that due to strong momentum for hydrogen projects, the overall picture provided today is bound to evolve quickly with new projects announced and more information for existing projects coming up in the next months.

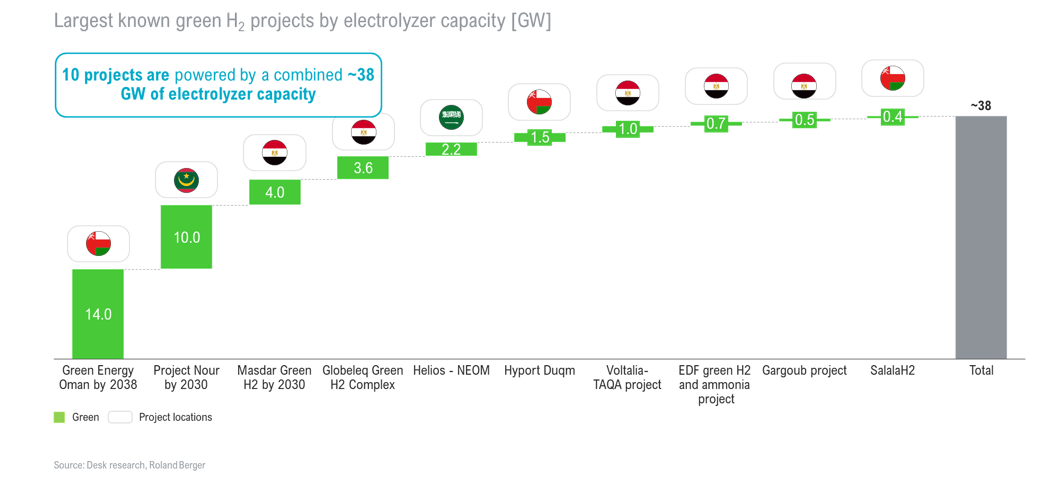

Among projects of global relevance on more advanced stages, NEOM in Saudi Arabia reached financial closure at the end of December 2022 [5] and it is currently under construction. A 4GW of dedicated renewable energy (solar and wind) will power the world's largest hydrogen plant, set to produce 1.25 Mtons/a of green hydrogen. Currently, only few pilot projects are operational, and more developments are expected in the coming years.

| Number of Projects | Electrolyzer Capacity (MW) | H2 Production Capacity (mtpa) | Ammonia Production Capacity (mtpa) | Status | |

|---|---|---|---|---|---|

Algeria | 1 Green | N/A | N/A |

| MoU |

Bahrain | 1 Green | 4 | N/A | N/A | Announced |

Egypt | 20 Green 1 Yellow | 100-4000 | 0.015-2.2 | 0.09-3 |

|

Israel | 1 Green | 0.4 (Pilot) -30 (Phase 2) | N/A | N/A | Development |

Jordan | 1 Green | N/A | N/A | N/A | Feasibility Study |

Mauritania | 2 Green | Up to 10000 | Up to 1.7 | Up to 10 |

|

Morocco | 6 Green | 20-100 | Up to 0.031 | Up to 0.183 |

|

Oman | 7 Green 1 Blue 1 Yellow | 35-14000 | 0.0003-1.8 | 0.1-10 |

|

Qatar | 1 Blue | N/A | N/A | 1.2 | MoU |

Saudi Arabia | 2 Green 2 Blue 1 N/A | Up to 2200 | Up to 1.2 | Up to 1.2 |

|

Tunisia | 2 Green | N/A | N/A | N/A | Announced |

UAE | 7 Green 1 Blue 1 Yellow | Up to 200 | 0.04-6.57 | 0.035-1 |

|

Capacity planned

The hydrogen market in MENA is, thus, in an early stage of development. Project data (e.g. renewable energy use, electrolyzers, annual production) are not always publicly available or credible yet. Looking for example at announced Electrolyzer capacities, the range covers a wide spectrum from a few hundreds of MW up to 14 GW (!) for the biggest projects announced in Oman.

Interconnections and their role in exporting towards EU

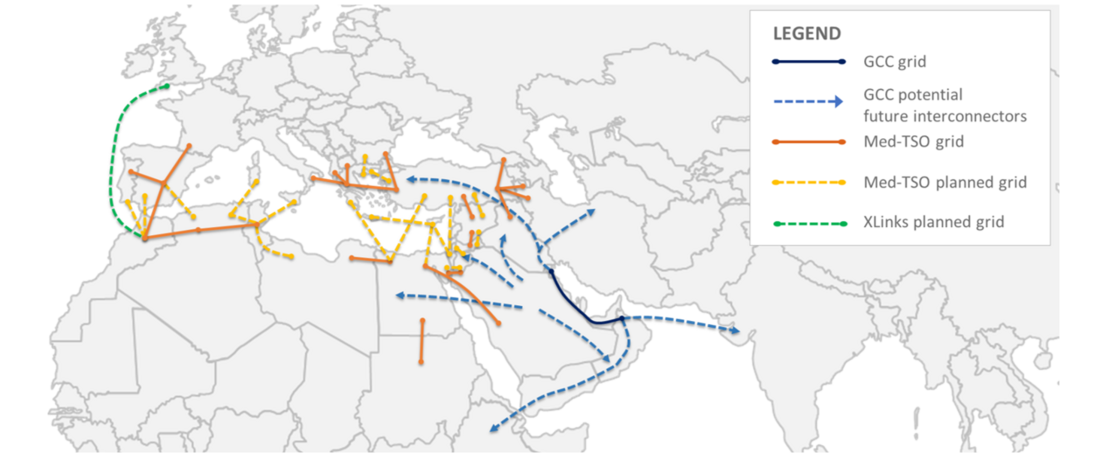

The Russian invasion in the Ukraine has led to immediate changes in the global gas (mainly LNG) and oil trade flows. On the long term, it emerged a greater awareness of low costs, emission free and high security of supply from renewable sources (and possibly nuclear). It appears that energy importing regions such as EU and Japan have finally discovered the vast potential of MENA as a global zero emission energy supplier with highest security of supply. This underlines the need to cooperate for an accelerated clean energy transition [6]. In this context, the MENA region will claim a prominent role, leveraging its abundance of wind and solar sources as well as a strong momentum in power, hydrogen and infrastructure projects. Cross-country and cross-continent interconnections e.g. with the European Internal Market will be pivotal to connect the two continents and enable a long-lasting supply from MENA countries to the EU [7]. An overview of current grid interconnections and potential export routes is provided below.

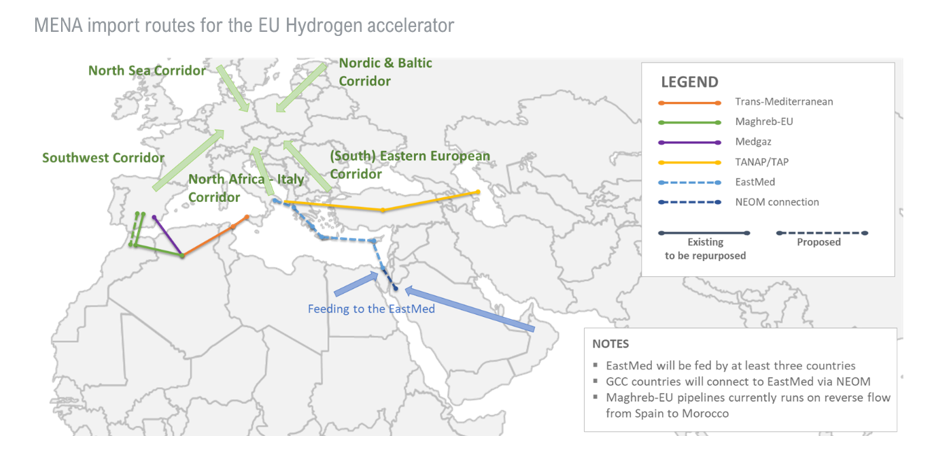

While MENA countries are pretty well interconnected electrically, power connections with Europe are still limited to Morocco – Spain and Turkey – Bulgaria/Greece. Several new interconnections between North Africa and Europe are being proposed (notably a connection between Morocco and the UK, XLinks, Tunisia - Italy and Egypt - Cyprus - Greece). Gas infrastructure in Maghreb is also connected with the EU. Gas infrastructure seems still to be extended, but one may expect that investments will be diverted to new hydrogen links or converting existing gas infrastructures to hydrogen in Maghreb, East Mediterranean and so that Gulf States will eventually be connected with Europe.

In the context of the EU hydrogen accelerator, the MENA would contribute to feeding the East Med import route under development.

Conclusion

In the last decade the ‘net zero emission’ objective has been added to the traditional “security” and “economy” objectives of the energy markets. Hydrogen from emission free sources is best positioned to taking over the role of fossil energy carriers. MENA is sacred with an abundant low-cost clean energy potential. The region is presently announcing and preparing a large amount of clean hydrogen projects. In the coming decades MENA is expected to be a major supplier of physical hydrogen and related green and emission related certificates into the local and global traded markets.

Thumbnail & banner credit: Sergei Dubrovskii on iStock

- [1] International Energy Agency (2021), Net Zero by 2050, IEA, Paris

- [2] van Son P., Isenburg T., (2019) “Emission Free Energy from the Deserts”, Smartbooks, The Hague. Available at: www.amazon.com/Emission-free-energy-deserts/dp/9492460262

- [3] fm.gov.om/oman-announces-investment-opportunities-in-green-hydrogen/

- [4] gulfbusiness.com/uae-completes-first-phase-of-national-hydrogen-strategy/

- [5] www.thenationalnews.com/business/energy/2022/12/18/saudi-arabias-neom-signs-agreements-with-banks-to-finance-green-hydrogen-project/

- [6] van Wijk A., Wouters, F., Rachidi, S., Ikken, B. (2019) A North Africa - Europe Hydrogen Manifesto. dii-desertenergy.org/wp-content/uploads/2019/12/Dii-hydrogen-study-November-2019.pdf

- [7] van Wijk A., Westphal K., Braun J.F. (2022) How to deliver on the EU Hydrogen Accelerator. dii-desertenergy.org/wp-content/uploads/2022/05/How-to-deliver-on-the-EU-Hydrogen-Accelerator_V9-1.pdf