Operational impact of COVID-19 on Australia’s National Energy Market

The impact of COVID-19 on the operations of the National Energy Market (NEM) has been largely managed to date. This is thanks to the prompt and careful actions of all our market participants, energy consumers (both major and minor) and governments.

However, COVID-19 precipitated the need to evaluate low demand scenarios ahead of schedule and may introduce new coordination challenges, due to deferred outages over the usually maintenance-heavy autumn shoulder period.

by Sorrell Grogan, Darren Spoor, Ellise Harmer, Babak Badrzadeh

Australian Energy Market Operator (AEMO)

Scenario modelling

The COVID-19 pandemic served as a catalyst for AEMO and network owners to conduct extensive scenario modelling, create operational plans for periods of sustained demand reduction in excess of 20%, and plans to cater for the loss of large generating facilities. AEMO studies showed managing such outcomes would be particularly challenging in the South Australian (SA) and Victorian regions, which are two of the five NEM regions AEMO operates.

In SA, operational demand is on the cusp of reaching levels that mean the minimum active power export requirements of synchronous generators (required to remain online to maintain sufficient system strength) cannot be met natively by the region. Driven by world-leading distributed solar photovoltaic (PV) uptake in the state, this “minimum demand” issue is most acute in the middle of the day during shoulder periods, which are also the periods where the bulk of network maintenance activities occur. In response to COVID-19, operational advice was formulated to identify generator dispatch patterns that had the lowest possible continuous active power export requirements, and implemented a revised generation shedding scheme, which extended to embedded generators. Constraints were also revised to cater for mass-disconnection of distributed PV for credible contingencies in the SA metro region.

In Victoria, reductions in operational demand were found to compound existing steady-state voltage control problems in the 500 kV network, whereby 500 kV lines were taken out of service to reduce voltages from low load. This backbone network supports the only synchronous connection to the South Australian region (complicating the SA issue above) and connects major industrial loads to large generation systems. The scenarios investigated showed that demand reductions of 20% would require even more 500 kV lines to be taken out of service, compromising system resilience and potentially further degrading system strength in remote regions. However, it also showed that the loss of a key synchronous generation facility on the 500 kV system could be catered for during low-load conditions.

Although these issues were not a result of COVID-19, concern around the COVID-19 impacts served to bring forward the development of the extremely low-demand scenarios, power system models and action plans required to manage such an eventuality.

Demand changes

The most measurable metric for COVID-19’s impact in Australia’s energy operations is the reduction in demand and a change to the demand profile. In the National Electricity Market, modelling of demand show an average 4% reduction for the Queensland region, and 5% reduction for the New South Wales region (largest region by demand) across the day on workdays. In Queensland and New South Wales, morning peaks have also seen occasional demand reductions as high as 10% during April and May. The regions of Victoria, South Australia and Tasmania have shown only marginal reduction in demand to date.

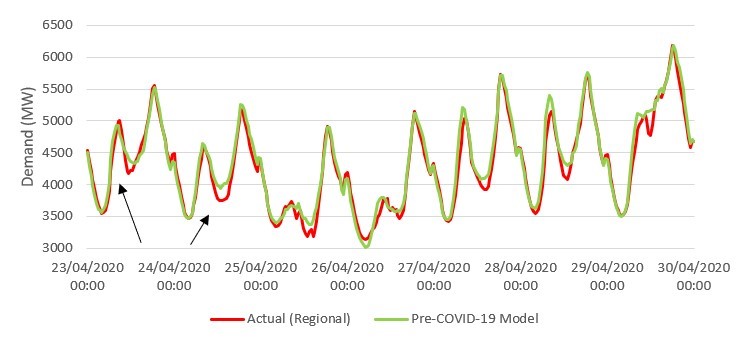

Figure 1 - Victorian actual operational demand against pre-COVID-19 control model

The shape of the diurnal demand cycle saw a profile change, with the morning peak starting up to 60 minutes later in all demand regions. Given that many citizens are now working from home, this shift is attributed to a general reduction in travel time to workplaces and reduction in morning heating or cooling demands from commercial businesses.

Worksite changes

A typical (and unsurprising) trend seen across the industry was to move all corporate and non-field staff to a working from home arrangement. This was true for the generation, transmission and major industrial load organisations AEMO has contacted.

Generators

Generation stations that are constantly staffed (typically large thermal units) reported both changes to the way their site staff interacted, along with immediate implementation of their crisis management plans. Typical changes reported included:

- Careful shift changeover management, so that staff on different shifts would never meet;

- Having “tent-cities” at the ready should the situation worsen (including establishing a secure supply chain for staff personal needs); and

- Direct monitoring of local hospital statistics to determine the trend for the immediate geographical area.

One generation organisation even reported the creative re-purposing of their fleet of thermal cameras, usually used to find hotspots in generator windings and tube leaks, to check staff temperatures as they came on shift.

Thermal generators also indicated a desire not to bid their units at full capacity, but rather to operate up to approximately 80-90% of rating, to avoid the marked increase in plant stress that occurs at the highest output levels.

Control Rooms

Control rooms across the industry implemented similar protocols to manage the risks from COVID-19. These initiatives included restricting access to control rooms to only shift staff and a 14-day quarantine was typically required for anyone who had recently travelled. Control room teams were generally split into two groups to minimise the risk of infections spreading through the entire team. In many cases, one of these teams worked from backup or temporary control room facilities.

A further trend seen in strategic control rooms was to “reactivate” recently retired staff, by bringing them up to date with current operating procedures, and, where possible, setting up remote workstations. It is understood that this arrangement has not needed to be called upon by any organisation to date, due to the careful handling of the situation with the mitigation methods described above.

Maintenance and outages

The most common initial response reported from network asset owners was to proceed only with critical asset maintenance, with strict social distancing rules enforced for field crews. This saw pre-COVID-19 asset maintenance outage schedules slightly increase in duration to account for the added difficulty of field crews working with increased physical distance and minimising contacts (e.g. number of people in lifts, permitting arrangements, etc.). As the COVID-19 issue persisted without any infections in field crews, this approach was revised by most asset owners to also include less critical but important maintenance.

In addition to lower-priority outages being reviewed and, in some cases, delayed, a notable impact from COVID-19 has been to closely review long or complex outages. This has been required across both the network and generator areas of the industry to better understand the complexity of the outage and to understand where key parts and labour are being sourced. Some generators have also taken advantage of the benign market conditions to continue with outages and do extra work on the unit while it is already out of service. However, several outages have been shifted to the spring shoulder period later this year. Subsequently, AEMO has seen a marked increase in the number of coincident high-impact outages scheduled for the second shoulder period, comprising simultaneous generator and network outages. AEMO has flagged this as a key medium-term risk and is working closely with asset owners to prioritise and coordinate outages ahead of the challenging Australian summer period.

Market impact

Wholesale energy prices in the NEM saw average decreases of approximately 50% from March to May 2020. However, attributing such decreases to the pandemic response alone would be misleading, as prices were already low prior to domestic pandemic restrictions. Rather, the price reduction is coincident in both timing and proportion to low international oil prices, to which Australia’s domestic gas prices (and hence gas-powered generation fleet) are linked.

The Australian Energy Market Operator (AEMO) performs an array of gas and electricity market, operational, development and planning functions. It manages the National Electricity Market (NEM), the Wholesale Electricity Market (WA) (WEM) and the Victorian gas transmission network. AEMO also facilitates electricity and gas full retail contestability, overseeing these retail markets in eastern and southern Australia. It is additionally responsible for national transmission planning for electricity and the establishment of a Short Term Trading Market (STTM) for gas.

This article is supported and reviewed by the SC C2 Chair, Susana Almeida de Graaff.