Short-term flexibility in power systems: drivers and solutions

The Technical Brochure "Short-term flexibility in power systems: drivers and solutions" explores the need for flexibility in the time frame between real time and up to 12 hours ahead in the future power system. First drivers are discussed, followed by a range of solutions. The main contribution of the report is based on a survey that was answered by 22 countries across the globe, about drivers for the need for flexibility, expected future providers as well as future market arrangements. The increased penetration of wind and solar PV are clearly seen as the main driver, while hydro and batteries are expected to give the most important contributions, however with some variation between continents.

Convenor

(NO)

G. DOORMAN

Secretary

(SE)

R. SCHARFF

G. THORPE (AU), G. VERBIC (AU), C. DORNELLAS (BR), P. VALENZUELA (CL), C. CORREA (CO), L. RAMIREZ (CO), M. LAASRI (FR), C. HEWICKER (DE), J. RICHSTEIN (DE), K. PAWAN KUMAR (IN), J. GING (IE), I. ARONOVICH (IL), K. FURUSAWA (JP), Y. TAKAMIZAWA (JP), P. GIESBERTZ (NL), P. RODILLA (ES), T. PIYATERAVONG (TH), J. BLADEN (US), J. FRASIER (US), A. KEECH (US), J. LIN (US), A. TUOHY (US), C. WANG (US)

The continuing increase of non-dispatchable generation such as solar and wind presents challenges for handling the real-time balance between production and demand. The growing deviations between forecast and actual generation ask for a broader range of solutions to ensure that there is enough flexibility in the system to continue to meet that real-time balance.

Flexibility is a characteristic of capacity. If we view capacity as the possibility (or option) to either consume or produce electrical energy, then flexibility is the capability to use this capacity freely and to adapt the capacity responding to price signals. The more flexible the capacity (in terms of lack of constraints), the better its ability to serve the short-term needs of the power market.

This report is about "short-term" flexibility. It divides flexibility into four time horizons inspired by (but not restricted to) the European TSOs' mechanisms for system balancing (from frequency containment reserve to replacement reserve) and ranging from real time to "short-term", defined as being between 15 minutes and 12 hours. Flexibility aspects beyond 12 hours are not considered. Primarily through a survey, this report identifies future solutions.

The need for more flexibility is driven by a number of factors:

- The increase in variable renewable energy source, primarily wind and solar PV, including forecast errors and lack of observability

- Distributed generation and storage

- Decommissioning of conventional generation

- Inflexible dispatch of power plants

- Electrification of transport and industry processes

- Outages

- Allocation of cross-border capacity

While most of these factors are intuitive, a few require explanation. While storage clearly is a source to deliver flexibility, it can also work in the opposite way if the dispatch is not aligned with the system needs. Allocation of cross-border capacity refers to how such capacity is allocated between time horizons – this is relevant where cross-border capacity is allocated rather than free flowing in dispatch. If all corss-border capacity is allocated ahead of the delivery e.g. to the day-ahead market without the possibility to update scheduled exchanges close to real time, it is difficult to use it for flexibility purposes, which implies a local need for more flexibility from other resources. Both these factor indicate the importance of market design. Outages have always created the need for handling sudden reductions of injections. This is not expected to change in the future, but large scale deployment of renewable generation with small unit sizes may reduce the probability of large single outages. On the other hand, large interconnectors between countries or to offshore wind parks may draw in the opposite direction.

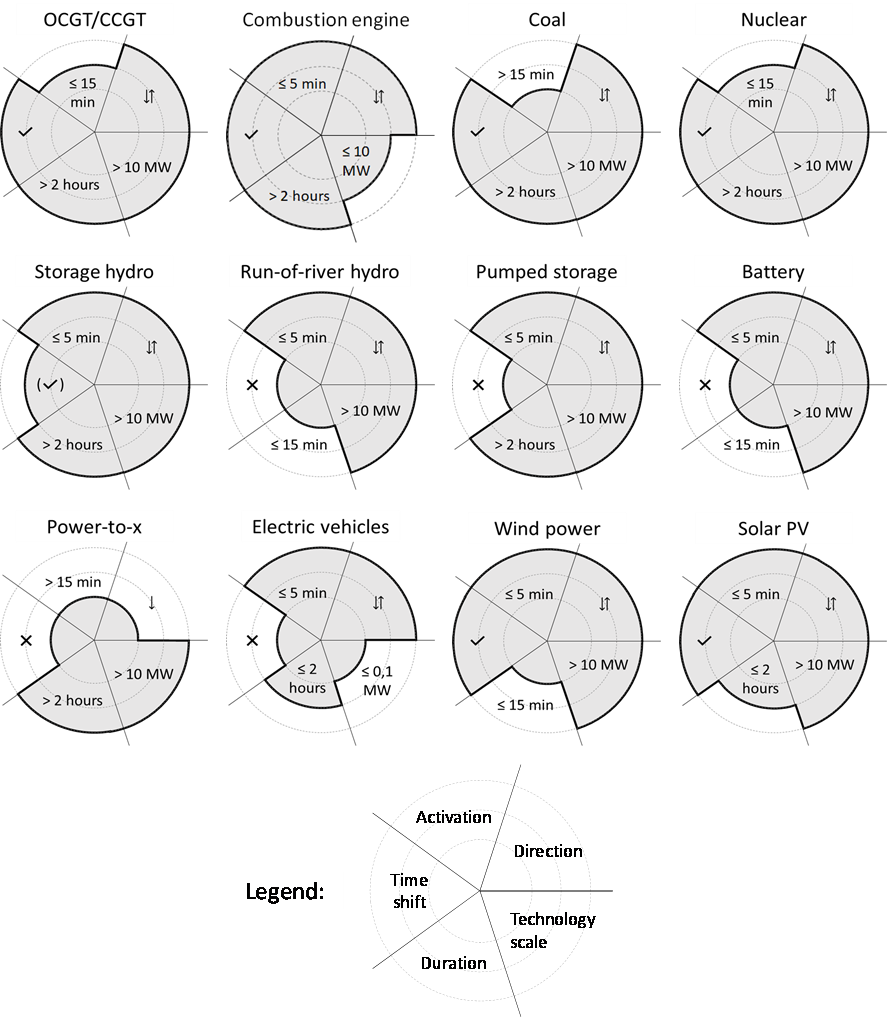

A number of resources to provide future flexibility are identified in the report. These are characterized by their speed, technology scale (before aggregation), direction (up-down-both), duration and the need for time shifting. The report briefly discusses the various types of generation, being thermal, nuclear and hydro and also wind and solar PV. Subsequently it describes storage technologies: batteries, pumped storage hydro, "power-to-x" ("x" being e.g. gas, heat) and electric vehicles, the latter being basically batteries but with different characteristics. Another relevant resources is demand response, while transmission, although not being flexibility resources in their own right, gives access to flexible resources over larger areas.The figure below given an overview over the characteristics of the various resources.

Figure 1 - Overview over flexibility characteristics (note that the bidirectional capabilities of wind and solar PV would require them to produce below potential output)

A survey was answered by 22 respondents from five continents, representing a wide range of power system and market characteristics. In the following, we briefly summarise the results of this survey with regards to drivers for the need for short-term flexibility, providers of future short-term flexibility and arrangements to increase future short-term flexibility.

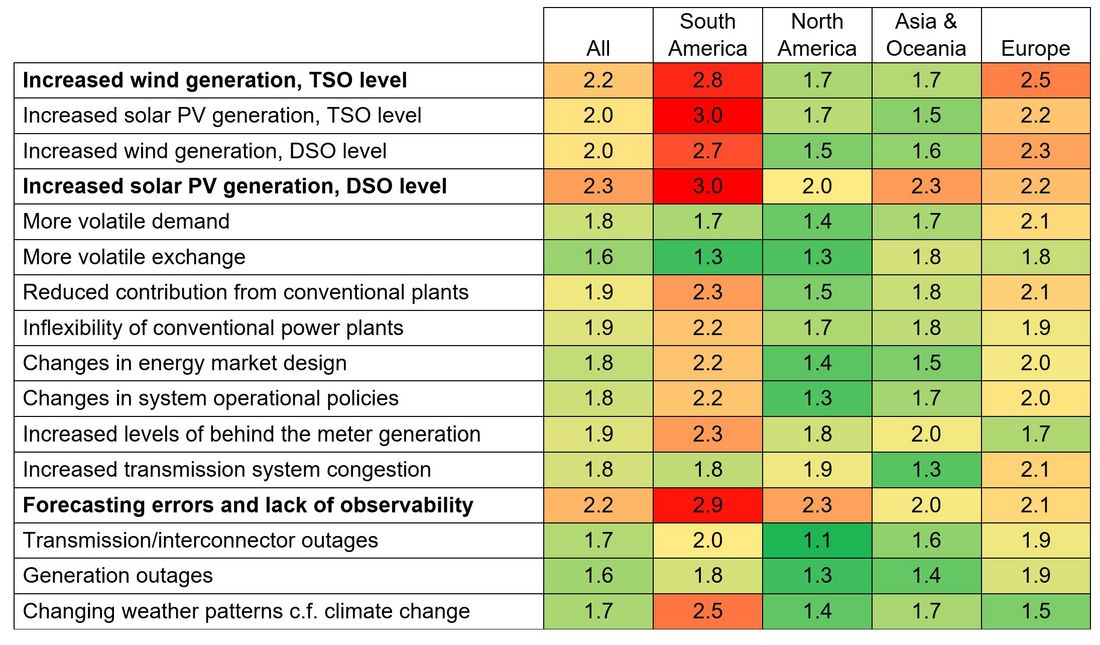

Drivers for the need for short-term flexibility

The table below shows the respondents' views on the causes for the need for more short-term flexibility, differentiated between the continents. The table show an average across all time horizons; detailed response per time horizon are shown in the full report.

Table 1 - Drivers of increased need for flexibility

The survey asked to rank drivers as "Low", "Medium" or "High", which in the table is equivalenced with "1", "2" and "3" and colours green, yellow and red respectively. So, 3.0 / red indicates that all respondents have indicated the actual driver as having high importance, while 1.0 / green indicates the opposite. The table shows large regional differences for some drivers (e.g. solar PV generation at the TSO level) but also regional similarities for other drivers (e.g. inflexibility of conventional power plants). All responses were weighted equally – the answer from Northern Ireland had the same weight as that of e.g. India or PJM in the US. The values for each region are the average over the systems within the region and may hide significant sub-regional differences.

Increased wind power at the TSO level and increased solar PV production at the DSO level clearly stand out as the most important drivers, closely followed by solar PV at the TSO level and wind at the DSO level. System level forecasting errors and lack of observability are seen as equally important, and clearly closely related drivers. Other important drivers are reduced contributions from inflexibility of conventional power plants, as well as reduced contributions from those plants (assumed due to decommissioning), and increased levels of behind the meter generation.

There are significant regional differences. Wind and solar PV at the TSO level were seen as very important in South America, and slightly less in Europe, but not so important in Asia & Oceania and the US. DSO level solar PV was seen as important in all regions. 51 % of all respondents indicate the importance as high and 20 % as medium. Other answers with high regional variability were "Changes in energy market design" and "Changing weather patterns", both seen as having high important in South America but less so in other regions.

Differences across time horizons were not as large, but in general wind and solar PV are assumed to create most need for flexibility in the time horizon beyond 5 minutes. The same is the case for all other identified options, although forecasting errors are important for all time horizons, especially in South America (but not in the US). A general conclusion is that the respondents expect the major needs for more flexibility to occur in the time horizons between 5 minutes and 12 hours, and not in the shortest time horizons. This is probably due to geographical smoothing: although the variations from individual wind or solar PV plants may vary also in the very short-term, this will quickly be leveled out over larger areas. In this context it should be noted that virtually all respondents were TSOs, and none were DSOs. Because the latter cover smaller geographical areas, they could be more concerned also about shorter time horizons (e.g. solar insolation variations on a particular feeder).

An overall impression is that respondents in South America and Europe are more concerned about an increasing need for flexibility than those in North America and Asia and Oceania.

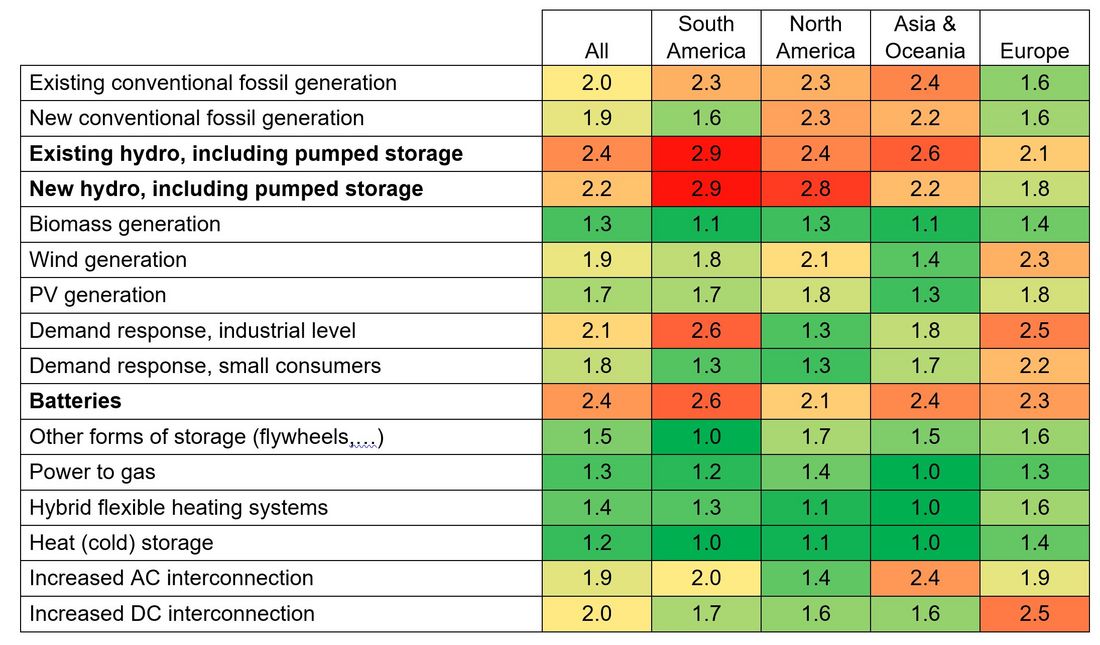

Providers of future short-term flexibility

Table 2 shows the responses on the questions about expected future providers of short-term flexibility.

Table 2 - Providers of short-term flexibility

The highest expectations were to existing and new hydro and batteries, and somewhat less industrial level demand response and existing conventional fossil generation. If time horizons are taken into account, batteries stand out as the unambiguously most important future source for the time horizons below 5 minutes, with average values of 2.6-2.7 across all regions, see the full report for further details.

There are significant regional differences. Expectations of hydro are high in all continents, but lower in Europe than in the rest of the world. Also expectations of conventional fossil generation are lowest in Europe, probably related to the continent's climate policies that imply decommissioning of large shares of such generation. On the other hand, expectations of contributions from wind generation, demand response and DC interconnectors are high in Europe, but less so in the rest of the world. Asia and Australia have high expectations from increased AC interconnection, which in Australia's case means between states.

There were generally small expectations of contributions from biomass generation, power to gas, hybrid flexible heating systems and heat(cold) storage. The survey does not reveal if this is because respondents do not believe these technologies will generally not reach significantly larger penetration in the next 5-10 years, or that their contributions to flexibility will be small despite their level of penetration.

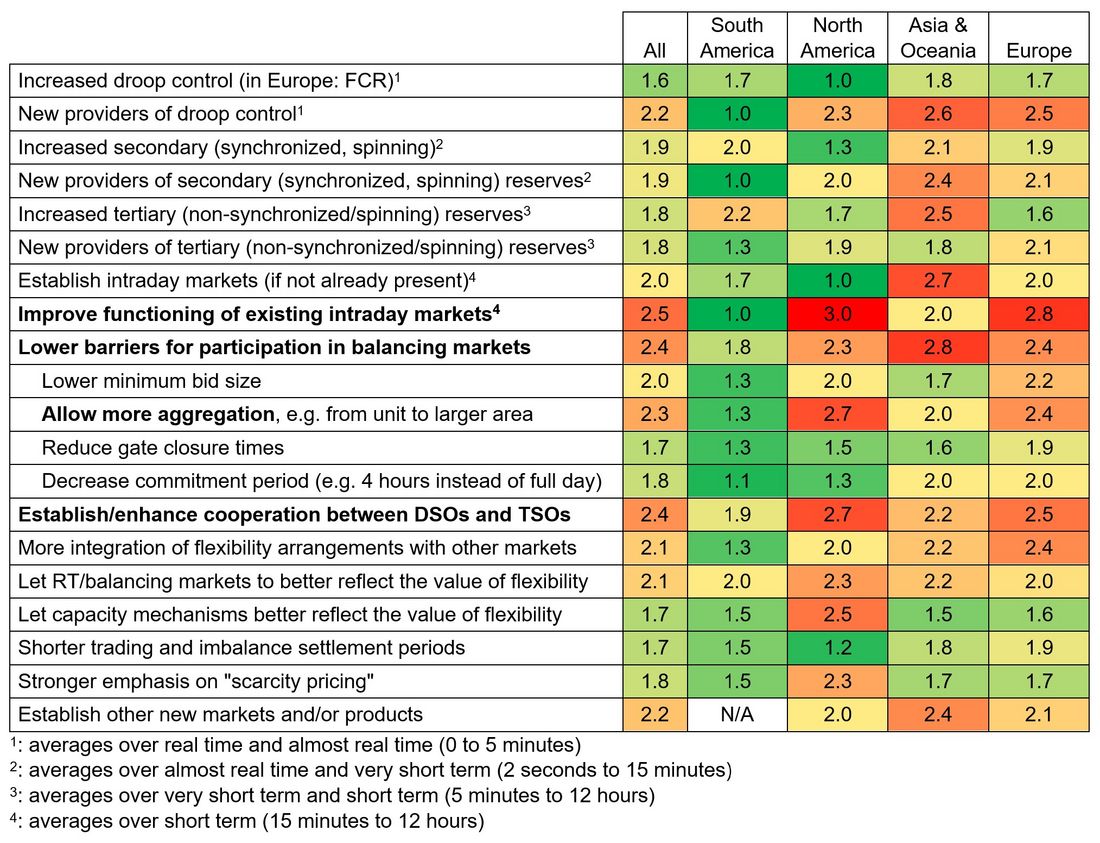

Arrangements to increase future short-term flexibility

Table 3 shows the responses to questions about arrangements. Note that while values in the preceding tables were averaged over all time horizons, in the table below, several of the proposed arrangements are averaged only over relevant time horizons in order to reveal their real importance. E.g. droop control is not relevant beyond 5 minutes, and including all time horizons would dilute the real impact.

Table 3 - Arrangements to increase future short-term flexibility

The overall most important measures for all continents are:

- Improve functioning of intraday markets.

- Lower barriers for participants in balancing markets, and among these especially allowing more aggregation.

- Establish/enhance cooperation between DSOs and TSOs in order to utilize mutual resources.

Improving intraday markets has very high interest in North America and Europe. Note however that there was only one respondent who answered the question in North America. Establishing intraday markets has a corresponding high interest in Asia and Oceania (there was only one respondent in Europe)

The lowest interest have increase volumes of droop control and reduction of gate closure times.

In South America, there is generally little interest for any of the proposed measures, with the exception of increased volumes of secondary and tertiary reserves and DSO/TSO cooperation (medium). North America corresponds quite well to the average for most questions. In Asia/Oceania, there is more interest in new providers if droop control and secondary reserves, but also increase volume of tertiary reserves. In Europe, there is clearly more interest for new providers of reserves than for increased volumes, and there is more focus on increased integration of balancing markets.