Electricity storage in Greece: State-of-play & near-term outlook

Even though electricity storage is recognized as a prerequisite for the decarbonization of the power sector, the development of storage facilities is still facing legal/regulatory barriers and investment feasibility concerns. This article highlights key steps recently taken by the Greek State as regards the legal/regulatory framework and appropriate State aid schemes, to kickstart electricity storage activity and allow for an efficient and timely development of facilities.

By Apostolos Papakonstantinou

Storage facilities in operation & anticipated needs

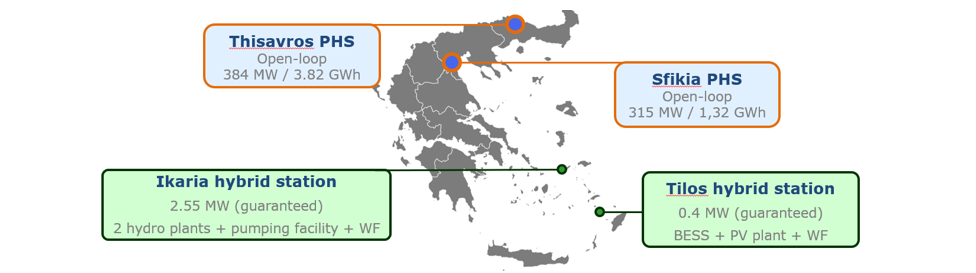

Currently there are four (4) storage plants operating in Greece, two open-loop pumped-hydro storage (PHS) stations in the mainland (700 ΜW in total) and two small hybrid RES-storage stations in non-interconnected islands (just 3 MW).

The updated target for a renewable energy source (RES) share of ~80% in the electricity sector, set in the National Energy and Climate Plan (NECP) that is currently being revised, cannot be met without substantially increasing the storage capacity of the system. Considering the energy arbitrage and flexibility needs of the Greek power system, a mix of short (~2 MWh/MW) and longer (>6 MWh/MW) duration storages has been identified as optimal. In the short run, storage is primarily needed for balancing services and to a smaller degree for limited energy arbitrage. Long-term storage needs, on the other hand, are driven by the fast rising RES penetration levels, to provide energy arbitrage on a daily and multi-day cycle, as well as to contribute to system adequacy. Estimates vary, but a total storage capacity of at least 4 GW and 15-20 GWh is considered appropriate to support system needs over the next decade.

Currently there is a growing interest for investments in storage facilities in Greece. Licensed projects mostly consist of Li-ion battery energy storage systems (BESS), either stand-alone or integrated in PVs, as well as PHS facilities [1].

Regulatory advances & State aid schemes

In January 2021, the Greek Ministry of Environment and Energy established a “Storage Task Force”, entrusted with the task to propose a strategy, an action plan and specific institutional measures to enable the development, integration and effective market participation of storages. In July 2021, the Storage Task Force concluded its proposal, establishing the directions for amendments of framework around electricity storage [2]. The foreseen prioritization of use cases and functionalities of storage are:

- Grid-scale, front-of-the-meter (FtM) storage (market participation, PPAs, congestion relief),

- Behind-the-meter (BtM) storage in RES plants (RES energy time-shift, mitigation of curtailments, imbalance charges minimization, balancing services provision),

- Small-scale storage in consumer (prosumer) premises (cost reduction, peak shaving, enhanced exploitation of embedded generation, network congestion relief).

In 2022 major interventions took place in the legal framework to establish the activity of electricity storage, with law 4951/2022 introducing the following:

- Typology of storage -FtM facilities and BtM storage in RES plants and prosumers.

- Streamlining of licensing procedure.

- Participation in all electricity markets.

- Grid access: Storage enjoys precedence to RES, subject to operating restrictions, as discussed below.

- Regulated tariffs and avoidance of double charging.

Ministerial Decision 84014/7123, issued in the same year, established grid access priority rules for FtM storage facilities and for RES plants with integrated storage.

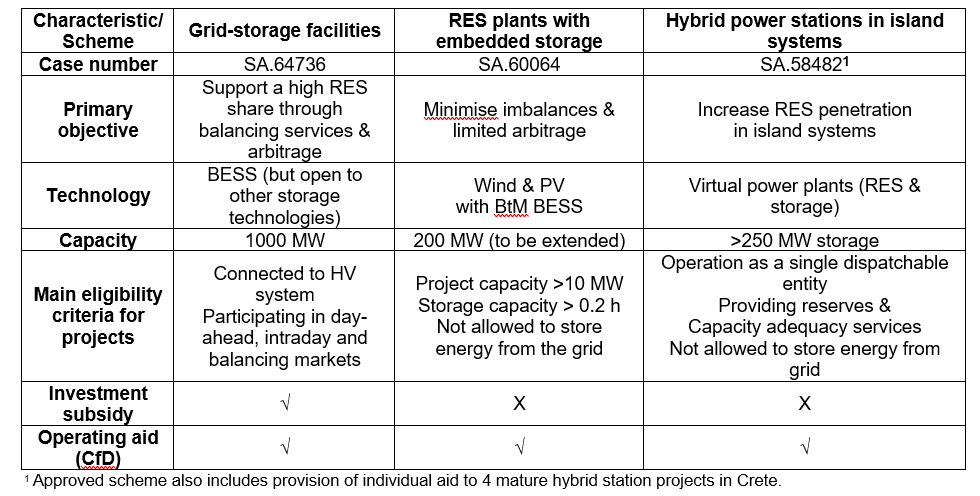

An amendment introduced in Law 4920/2022 enables granting of State aid to storage, in order to bridge the funding gap of investments and enhance their bankability. Financial support is available either through participation in competitive tenders or directly to individual projects, in the form of investment subsidies and/or annual operating aid. The Greek authorities have been successful in having 4 storage support schemes approved by the European Commission. The following table summarizes the main characteristics of the 3 schemes that involve open tender processes [3-5].

The 1st (out of 3) bidding process of the FtM grid-storage scheme (SA.64736) was successfully conducted in July 2023, for a total of 400 MW. The remaining 2 rounds will be completed in 2023. All projects are scheduled to enter operation before 2026. In addition, individual aid to the 680MW/6-h Amfilochia PHS Project has also been approved (SA.57473), aiming to support high RES penetration through arbitrage and curtailment mitigation, as well as contribute to resource adequacy. The aid comprises both an investment grant and a 2-way CfD [6].

RES hosting capacity & storage – operating restrictions

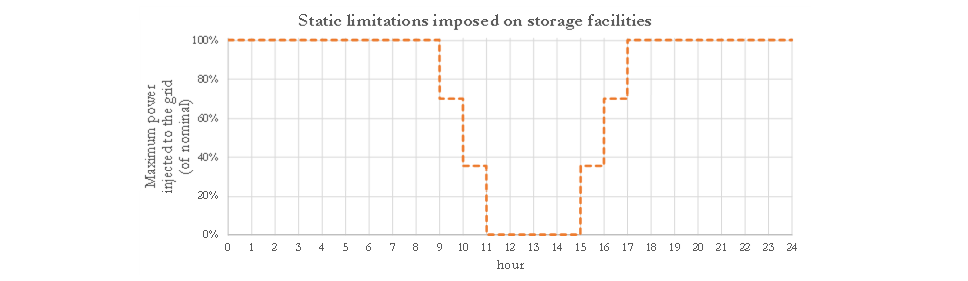

Network congestion is a major limitation in achieving decarbonization targets, in Greece and elsewhere, with RES hosting capacity of the grid being exhausted. Ministerial Decision 53563/1556, issued in May 2023, established operating restrictions applicable to RES and storage facilities, intended to mitigate network congestion and improve utilization of available RES hosting capacity. Initially, time-window static limitations will be imposed to storages operating in PV-congested networks, as shown below. Static restrictions will be gradually superseded by adaptive/dynamic limitations, applicable depending on prevailing conditions, based on market or out-of-market mechanisms.

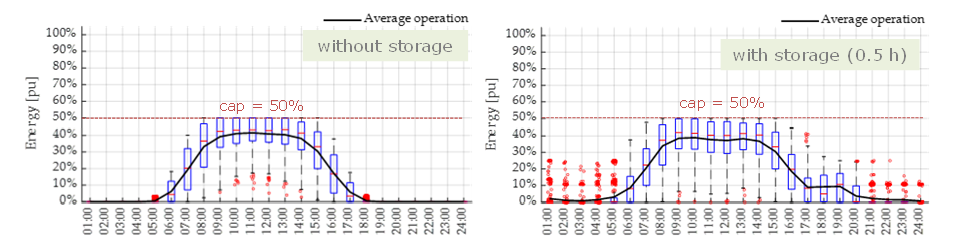

Static limitations are also foreseen for RES plants, initially in the form of output power caps, principally for PVs. Combined with BtM batteries, such restrictions are very effective in reducing occupation of available hosting capacity, while maintaining energy efficiency (i.e. minimizing rejected energy). At the same time, the market value of available solar generation is increased through time-shifting towards high demand and market price intervals. As an example, the average daily grid export profile is shown below for a PV plant capped at 50% of its installed capacity, without embedded storage and with a small (0.5 h duration) of BtM batteries.

Open issues & next steps

Important steps for the immediate future, to maintain the momentum in electricity storage development in the country, include the organization of tenders for hybrid plants in the islands, the introduction of support schemes for storage in customer premises and the promotion of BtM storage in RES facilities. The latter is key for the integration of RES generation, as it will allow imposing operating restrictions to accommodate a high RES capacity in congested areas of the networks, as well as to more effectively manage the increasing level of market curtailments faced by RES stations.

References

- Licensing registry for storage facilities in Greece: https://www.rae.gr/mitroo-adeion-ilektrikis-energeias/

- Storage Task Force proposal: https://ypen.gov.gr/wp-content/uploads/2021/07/Eisigisi_ODE_Apothikeysis-xwris-FEK-kai-praktika.pdf

- Approval of State Aid scheme SA.64736: https://competition-cases.ec.europa.eu/cases/SA.64736

- Approval of State Aid scheme SA.60064: https://competition-cases.ec.europa.eu/cases/SA.60064

- Approval of State Aid scheme SA.58482: https://competition-cases.ec.europa.eu/cases/SA.58482

- Approval of State Aid scheme SA.57473: https://competition-cases.ec.europa.eu/cases/SA.57473

Thumbnail & banner credit: George Desipris on Unsplash